Valuation extremes combined with macro inflection signals provide generational opportunities to position opposite the crowd for potentially large gains. At Crescat, we live for such times. We continue to believe we are on the cusp of a rare macroeconomic shift, like in 1972 and 2000, where a monumental investment setup exists on both the long and short sides of the market.

The years mentioned above immediately preceded the onset of roaring new secular bull markets in commodities coincident with the bursting of bubbles in crowded megacap growth stocks. The analogous scenario exists today. We believe a major stock market correction and stagflationary recession is ripe to unfold and it should soon be the best multi-year stretch to own precious metals and mining stocks since the US dollar was de-pegged from gold in 1971.

Growth Inflection at the Top

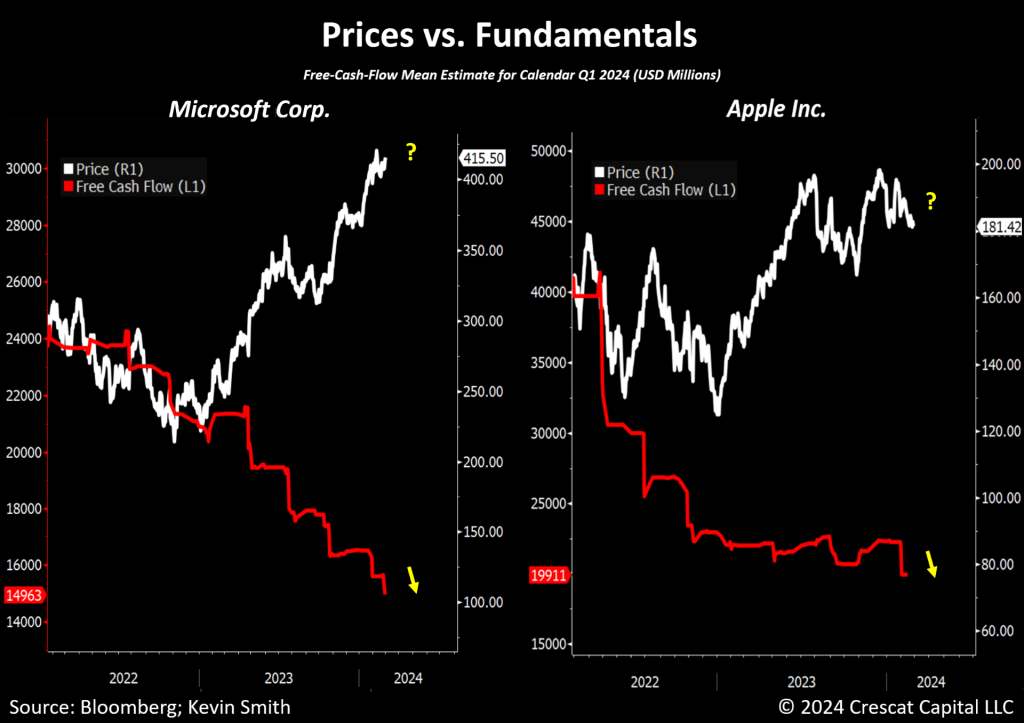

Artificial intelligence mania has caused stock prices to diverge from underlying fundamentals. Investors who have created much wealth in richly valued index funds and mega-cap tech stocks should consider preserving it now by significantly reducing that exposure. We think it is a great time to rebalance into value and macro managers with proven long-term track records of outperformance over multiple business cycles and into activist-oriented equity resource funds.

As the chart above shows, Wall Street’s mean analyst estimates for Apple and Microsoft’s free cash flow have been trending down for two years, but their stock prices have grossly diverged to the upside. If the current quarter forecast is in the ballpark, it will mark the transition from year-over-year FCF growth to decline for the two largest market cap stocks in the S&P 500.

This significant downturn in fundamentals shows that these two companies are performing more like mature cyclicals than growth stocks and have much more to lose from AI’s disruption at this point in the business cycle than they do to gain. Most of today’s megacap tech companies have simply become too big to sustain their formerly high growth rates. Alphabet with its dominance in search and advertising belongs in that mix too, as a leaked May 2023 Google memo warned, “We have no moat, and neither does Open AI”. These companies’ once hugely successful monopolistic business models are now under attack, just like in 2000, from both government regulators and technology disruption.

Y2K Comparison

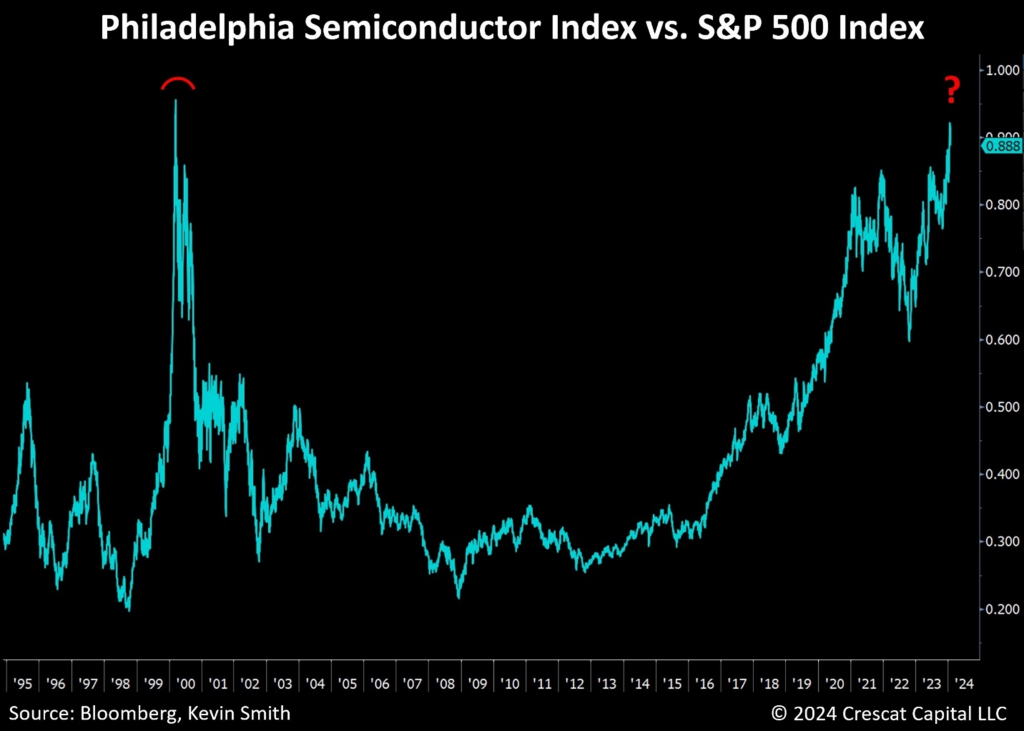

The hype over AI is just like the Internet frenzy in 2000. The innovation was real then, just like it is now, but the faith placed in tech companies via inflated valuations to be able to capitalize on it was, and is once again, overblown. Then it was a Y2K upgrade cycle that crested and crashed. Now it’s an AI processor craze, a burst of demand that has led to extraordinary growth and profitability for the industry leader, Nvidia, along with a surge relative to the market in the Philadelphia Semiconductor Index.

Nvidia has inflated the prices of its GPUs and is enjoying the windfall for now, a much-deserved capitalist monetization. But future chip supply runs deep. Intense competition from Intel, Advanced Micro Devices, and others looms. Prices go up and then come down in the highly cyclical semiconductor industry. We are highly confident that there will be a spending hangover by the many companies large and small that binged on Nvidia’s GPUs in the last year, paying up without any understanding at all of how they are going to achieve a reasonable return on that investment. This is just like the Y2K bubble. As a result, we believe the S&P 500 Index is in the vicinity of a major top ahead of an oncoming recession. Greed turning to fear and panic is the catalyst as people finally wake up to the truth of the underlying fundamental and macro dynamic at play.

Quality Resource Companies, A Major Buying Opportunity

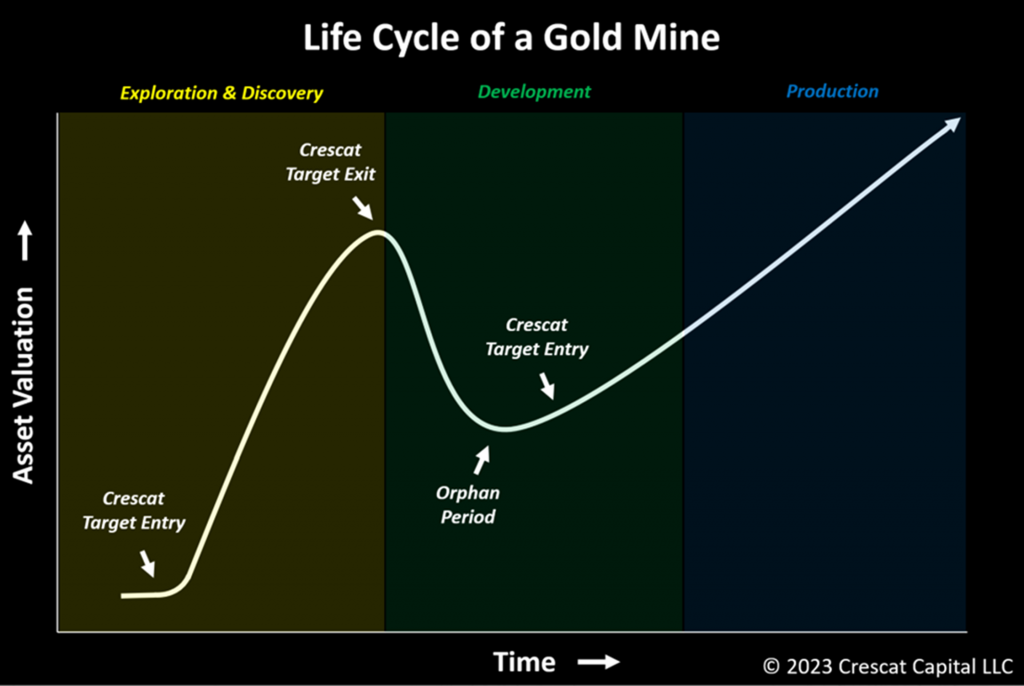

The mining industry has been in a capital-starved depression for more than a decade as technology investing has dominated risk capital flows. Crescat has been taking advantage of this distressed environment. For the past three and a half years, we have been funding the drilling and discovery of many large, commercial-scale, highly economic metal deposits in viable mining jurisdictions around the world.

We have built activist stakes and helped to create the world’s leading gold, silver, and copper mining exploration companies such as San Cristobal Mining, Snowline Gold Corp., Hercules Silver, Goliath Resources, Barksdale Resources, Blackjack Silver, Brixton Metals, Western Alaska, Tectonic Metals, Eloro Resources, Falcon Butte, Eskay Mining, Core Assets, and more. At the median, our funds now own more than 13% in 74 companies on a partially diluted basis including warrants. Our private placement investments in these public and private companies, together with our activist-directed use of proceeds toward prime drill targets, has all been orchestrated by one of the industry’s leading exploration geologists and mining executives, Quinton Henning, PhD, Crescat’s geologic and technical director.

Our campaign has helped to increase the intrinsic value of our companies and their assets by providing the capital to them for drilling to make discoveries while other investors have been absent and afraid. As a result, our companies now control what in our opinion is a number of the world’s new significant gold, silver, and copper discoveries. We further believe they are deeply undervalued and are prime acquisition candidates for major mining companies.

By our modeling, our portfolio of mining exploration companies, including their exploration assets and new discoveries, is deeply undervalued and underappreciated by the market today and offers extraordinary appreciation potential ahead of a likely M&A cycle and as we move into a new secular commodity bull market like in the decades of the 1970s and 2000s.

The opportunity to buy deeply undervalued precious metals ahead of a likely wave of new buying, in our view, has never been better. Big smart money investors like Stan Druckenmiller and Paul Elliot Singer are now just starting to make their moves into gold equities. The markets could turn quickly as these are the types of leaders that other smart money, and ultimately the crowds, tend to follow. Per the Duquesne Family Office’s recent 13F filing, Druckenmiller completely sold off his megacap tech holdings in Alphabet, T-Mobile, Broadcom, Alibaba, and Amazon last quarter. He also sold 29% of his Nvidia and established new positions in Newmont Mining, Barrick, and Freeport McMoran. Meanwhile, the Financial Times just reported that Elliott Management, one of the largest and most successful activist hedge funds is “setting up a company to hunt for global mining assets in the range of at least $1bn as it seeks to take advantage of the depressed valuation of groups operating in the sector.”

In our analysis, exploration and discovery is where most of the wealth in the mining industry will be created over the coming cycle, and so that is where most of our exposure today is focused. Given Quinton’s vast industry experience, we have a major edge over most managers who focus only on existing producers or advanced development projects. In contrast, we are very comfortable investing in exploration.

The intrinsic value of the likely future supply of metal that our activist-funded companies have already created, based on our geologic and economic modeling, is manyfold of what is currently reflected in the depressed market prices of our portfolio.

We have quietly acquired these deeply undervalued stakes, while momentum-chasing mobs have been focused on cryptocurrencies and megacap tech stocks. We have done this while our imbalanced government continues to stuff the world with its debt that is impossible to pay back without devaluation through money printing and taxation by inflation.

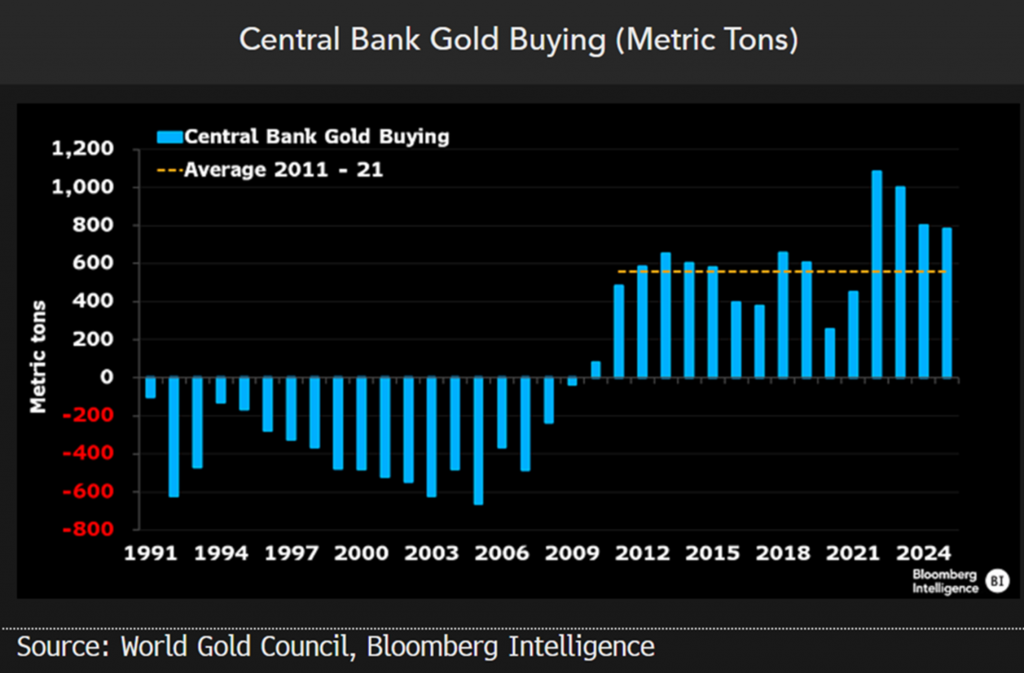

We think that gold’s unpopularity is temporary. While market prices have been down, we have continued to accrete substantial intrinsic value through our activist investment in metal exploration and discovery. The inflation writing is on the wall for US Treasuries and the dollar. Foreign central banks have already recognized this and have been accumulating gold to hedge their US Treasury foreign reserve risk.

In aggregate, our companies to date have generated an estimated 276 million gold-equivalent ounces of metal discoveries based on Quinton’s geologic modeling of what that future resource will be based on the drilling progress to date. For reference, the US Treasury, the largest owner of gold of any single entity on the planet, owns 262 million ounces of gold. Keep in mind, the UST’s gold is worth more because it’s fully milled, refined, and above ground while our companies’ gold and gold equivalent metal potential is still in the ground.

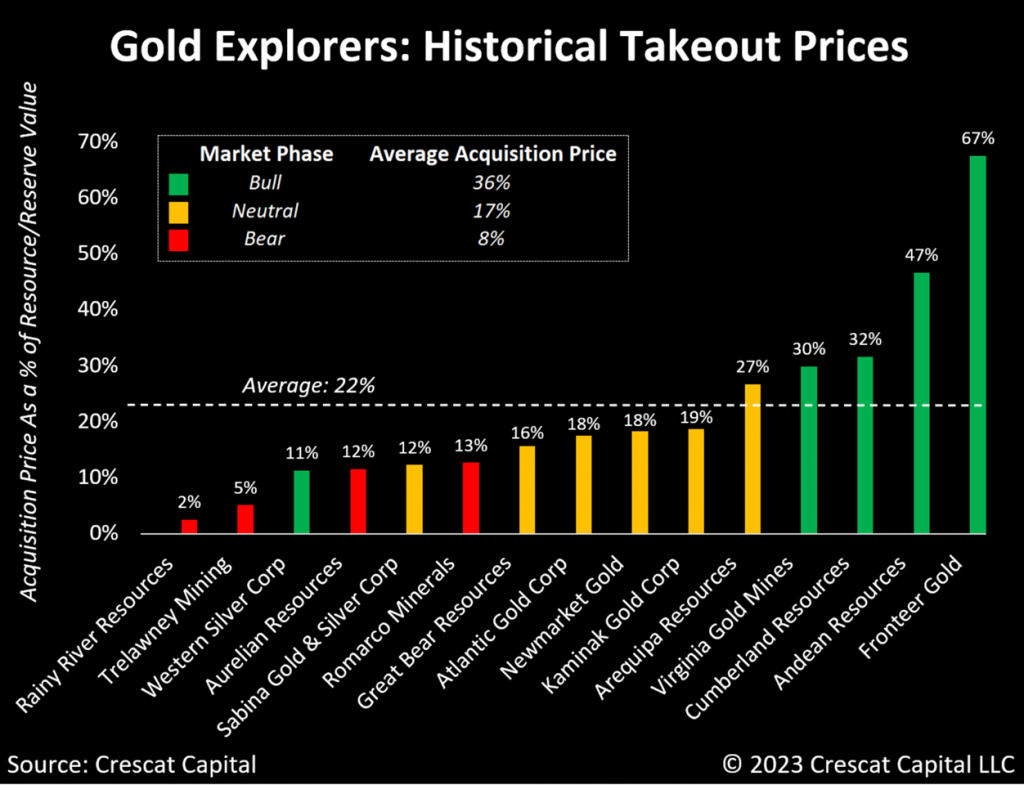

Western investor flows look like they are poised to return to gold. Crescat has prepared itself and our investors ahead of these likely flows which include a probable M&A cycle as the major mining companies are in desperate need of scalable new discoveries to replace their dwindling reserves. They will need to acquire or do deals with companies like ours with sizable economic deposits if they do not want to die of old age. On average, historically, when a major mining company has acquired an explorer, they have done so at 22% of the resource value as we have shown in the chart below. Our portfolio today is trading for less than 1% of Quinton’s estimated resource potential. We believe it is extraordinarily undervalued.

A Message from Crescat’s Founder and CIO

It is the best value and macro timing opportunity that I have seen in my career to be rotating out of crowded overvalued large-cap tech stocks and into the mining industry. I have been building fundamental quant models and managing money professionally for 32 years. My wife and co-founder Linda Carleu Smith, CPA, Crescat’s Chief Operating Officer, and I started the business together. We met in business school at the University of Chicago, Booth School of Business in 1990 and earned our MBAs in 1992. After business school, we joined Kidder, Peabody in Los Angeles together as a husband-and-wife brokerage team where we began building a high-net-worth client base. Crescat was formed out of those roots. Linda and I have built this business while managing money continuously for our client base since 1992 through multiple business cycles.

We moved to Golden, Colorado in 1994 where we first met Quinton who was getting his PhD in geology and geochemistry from the Colorado School of Mines. We met him and his family at Calvary Episcopal Church in Golden and he became one of our clients. Quinton has 42 years of mining industry experience, by the way. He worked for the majors, including Homestake, the predecessor to Barrick, Newcrest, and Newmont. He worked in his first mine in Colorado when he was 16. Quinton teamed up with Crescat in 2020 when we launched the Precious Metals Fund. He joined us full-time as a partner in 2021.

Linda and I met Tavi Costa, our fourth partner in Golden also in 2012. He had come from Brazil to the US on a Division 1 tennis scholarship. He had just graduated and was coaching at our tennis club. His real passion was investing, so we hired him as an analyst and sponsored his immigration. He is now our macro strategist and has been on the investment team for more than 11 years bringing extraordinary intelligence, work ethic, and insight to bear to help the firm’s research effort and to deliver our message as Crescat’s media ambassador.

In total, at Crescat we have a team of fourteen talented investment professionals today including both full-time employees and contractors. Three of them are talented programmers and data scientists, Ryan, Trevor, and James from Digeteks, all pushing forward our AI initiatives and helping me immensely on my career-long fundamental equity quant model project. They are also helping Tavi with his macro models.

Our successful experience with Quinton in going beyond my quant models and straight to industry experts for additional insight, has led us to employ similarly experienced industry veterans to help us analyze and exploit opportunities in energy and biotechnology themes. For this, we are grateful to Lisa Thieme and Lars Thiel, PhD, whom you might be hearing from lot more from in the years ahead. We are also extremely pleased to be working with Marek in investor relations, Tyler and Ravena our fund controllers, Cassie in marketing, Nathaniel who just moved up to analyst and assistant portfolio manager, and Kevin Box, Quinton’s geologic mapping guru.

Crescat is well prepared for what should be one of the most exciting growth periods in our company’s history. AI is awesome, by the way. We love it and are fully embracing it both in our quant models and in general. At the bottom of this letter is a poem to inspire that two totally free AIs helped me create.

The Opportunity Now

For existing investors in our funds, we understand that it is concerning to see the monthly values go down ahead of this shift that we have been calling for some time that has yet to emerge. We are extremely grateful to our long-term committed Crescat investors and appreciate your patience and endurance during our recent pullback. The partners and employees of Crescat are invested right alongside you and we are more confident in our positioning than ever.

Please understand that the pullback in 2024 year to date which has continued in February is mostly due to our activist mining theme, which is the largest long exposure across our funds. The pullback last year in our Global Macro and Long/Short funds was due mostly to the megacap shorts. The megacap shorts are not hurting us much at all this year. We are essentially flat on that theme and believe it is starting to turn in our favor. We are using mostly put options to minimize risk and get asymmetric upside return in those funds and remain well exposed to capitalize on this theme.

On the long side, the pullback in mining stocks does not alter the intrinsic value of our companies’ assets at all which are increasing through drilling and discovery. Based on our models, our companies, and our funds’ stakes in them, are worth multiples of where the market is currently pricing them. Our confidence in Quinton’s geologic understanding of this worth is how we can withstand the volatility of investing in this industry. Our “margin of safety” valuation approach allows us to weather pullbacks and to continue to raise and deploy capital at bargain prices with the belief that our future likely run-ups will much more than justify likely temporary downside risk.

For those who are not invested in our strategies yet, and who are considering it, we think it is a great time to act. Our value investment principles and models give us the confidence that our portfolios are worth substantially more than the current market price at any given time. As such, we believe pullbacks in Crescat’s strategies offer great opportunities for both new and existing investors to deploy capital.

As Warren Buffett advises, “It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. ‘Efficient’ markets exist only in textbooks.” Given what we believe is the true value of our activist metals long portfolio, the largest long exposure across Crescat’s private funds, we are confident the upside to reverse our recent pullback and push to substantial new high-water marks can be generated very quickly.

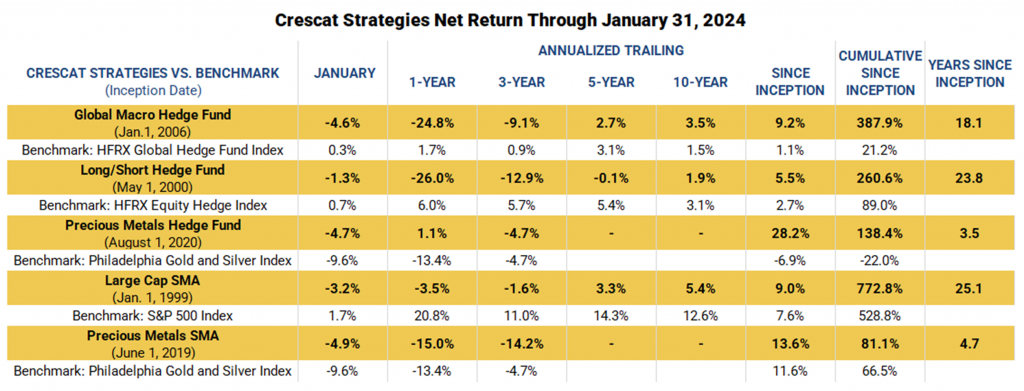

As a case in point, our Precious Metals Fund went up 251% net in just 8 months from August 2020 through May 2021 when money was flowing into metal exploration companies. Our activist mining portfolio substantially outperformed both gold and the major mining stocks during that time. Past performance is not a guarantee of future returns, but Crescat is capable of substantial upside moves that more than justify the risk as we have shown many times historically across all our strategies over multiple business cycles.

Given the US government debt and deficit problem, the likely government Keynesian fiscal and monetary stimulus response to the coming likely tech bust and recession should be the catalyst for one of the highest inflationary periods in US history along to go along with one of its biggest commodity bull markets ever. We will be watching these economic developments carefully. We believe the distressed value opportunity in the mining industry is creating an excellent entry point into our funds now.

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Historical net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all fees and expenses (including a management fee and incentive allocation, where applicable). Individual performance may be lower or higher than the performance data presented. The performance of Crescat’s private funds may not be directly comparable to the performance of other private or registered funds. The currency used to express performance is U.S. dollars. Investors may obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to info@crescat.net.

We encourage you to reach out to any of us listed below if you would like to learn more about how our vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Director

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

(303) 228-7371

© 2024 Crescat Capital LLC

Deep Learning

By Kevin Smith with AI Assist

In finance’s realm, where fortunes rise and fall,

Seekers of true wealth yield to a higher call.

AI, the modern oracle, predicts with unmatched skill,

Yet, it’s in age-old wisdom that we find the strongest will.

The Magnificent Seven, their influence vast,

Expand the market’s bubble, until it shatters at last.

Remember the tulip craze, once a coveted flower,

Its decline, a lesson in humility’s power.

From Mississippi’s sorrow to the South Sea’s grand illusion,

Bubbles burst leaving a dire conclusion.

From euphoric peaks to the valleys’ dark shadows,

Souls wear these trails seeking the hallowed.

The Jazz Age’s rhythm, the Nifty Fifty’s charm,

Dot-coms’ ascent, analogs of alarm.

While manias turn to panic as recessions cross,

Value investing embraces risk but avoids permanent loss.

AI enchants, with promises of tomorrow,

Yet history’s bill, a blend of joy and sorrow.

Heed the call of speculation’s wave,

FOMO’s a challenge for fools to brave.

As bubbles burst in life’s grand scheme,

Gold and silver, currencies of divine beam, gleam

Their constant shine, against time’s wear,

While cryptos are new and fiat devaluation is old, so prepare.

In the age of bits and bytes, as AI leads the dance,

It’s the divine touch that gives us a chance.

Forward we move, to a future we share,

Where souls and machines, in harmony, dare.

In the market’s whirl, where fortunes are spun,

An indomitable spirit, under the sun.

Riding innovation’s wave, as new techs emerge,

Our faith and insight, our future, converge.

In this vast tapestry, all have a role,

God’s grand design, the overarching goal.

Wisdom from above, in every plan,

Unveils the universe, a majestic span.

The divine spark within, through technology we dream,

Fueling our essence, not shallow memes.

From the market’s daily clamor to the closing bell’s toll,

Treasures in heaven feed our souls.

Creativity and spirit, in deep learning blend,

From dawn to dusk, in a dance without end.

A transformed world, where dreams are fulfilled,

And divine light shines, all darkness stilled.

Important Disclosures

Performance data represents past performance, and past performance does not guarantee future results. An individual investor’s results may vary due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars. Cash returns are included in the total account and are not detailed separately. Investment results shown are for taxable and tax-exempt clients and include the reinvestment of dividends, interest, capital gains, and other earnings. Any possible tax liabilities incurred by the taxable accounts have not been reflected in the net performance. Performance is compared to an index, however, the volatility of an index varies greatly and investments cannot be made directly in an index. Market conditions vary from year to year and can result in a decline in market value due to material market or economic conditions. There should be no expectation that any strategy will be profitable or provide a specified return.

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of a fund managed by Crescat may be offered to selected qualified investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund and which supersedes information herein in its entirety. Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, and should be made after reviewing such Offering Documents, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.

Investments highlighted or discussed have been selected to illustrate Crescat’s investment approach and/or market outlook and are not intended to represent the strategies performance or be an indicator for how the strategies have performed or may perform in the future. Each security discussed has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategies holdings. The securities discussed may or may not be held in such portfolios at any given time. Nothing in this letter shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in Crescat’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a Crescat hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. Crescat’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to Crescat’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any Crescat hedge fund with the SEC. Limited partner interests in the Crescat hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in Crescat’s hedge funds are not subject to the protections of the Investment Company Act of 1940. Performance data is subject to revision following each monthly reconciliation and annual audit. Current performance may be lower or higher than the performance data presented. The performance of Crescat’s hedge funds may not be directly comparable to the performance of other private or registered funds. Hedge funds may involve complex tax strategies and there may be delays in distribution tax information to investors.

Investors may obtain the most current performance data, private offering memoranda for Crescat’s hedge funds, and information on Crescat’s SMA strategies, including Form ADV Part II, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each Crescat hedge fund for complete information and risk factors.