Crescat’s Market Call – October 4th, 2024 Commentary

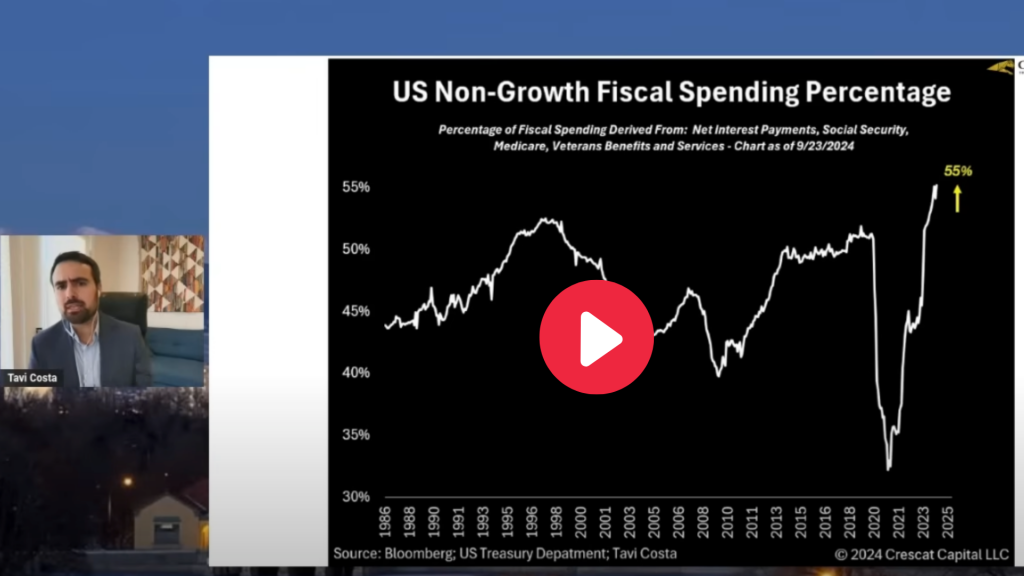

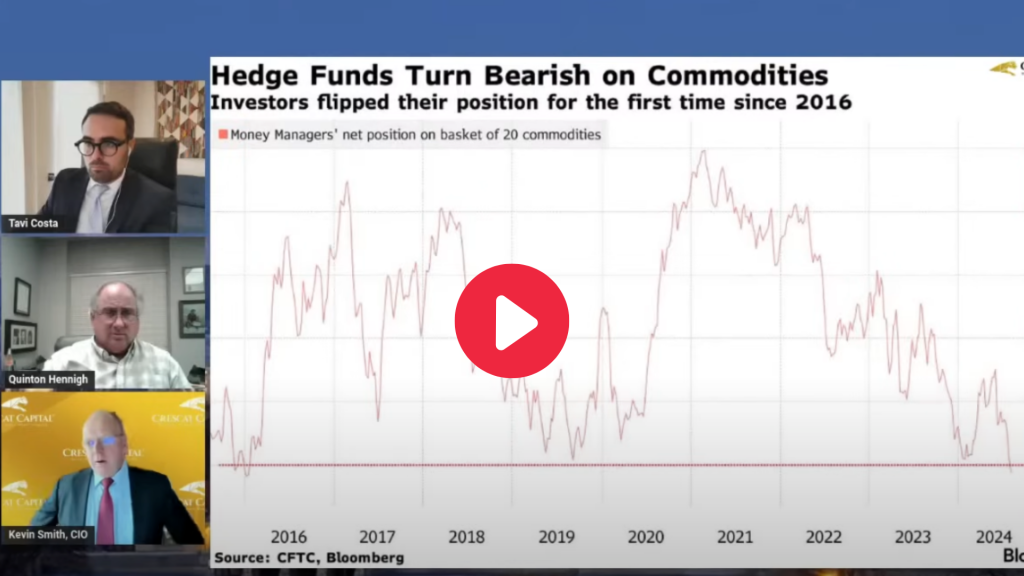

October 4, 2024 - In this Tavi Costa solo episode, he discusses key macroeconomic trends, particularly the inflationary impact of labor strikes and rising fiscal spending, which is largely non-growth-oriented. Crescat emphasizes the potential for heightened inflation due to increased global money supply and constrained commodity supplies, particularly in mining and agriculture. Silver is highlighted as a promising investment, as we believe demand is expected to rise due to supply shortages and shifting market dynamics. Learn More »

Crescat’s Live Market Call – September 20, 2024 Commentary

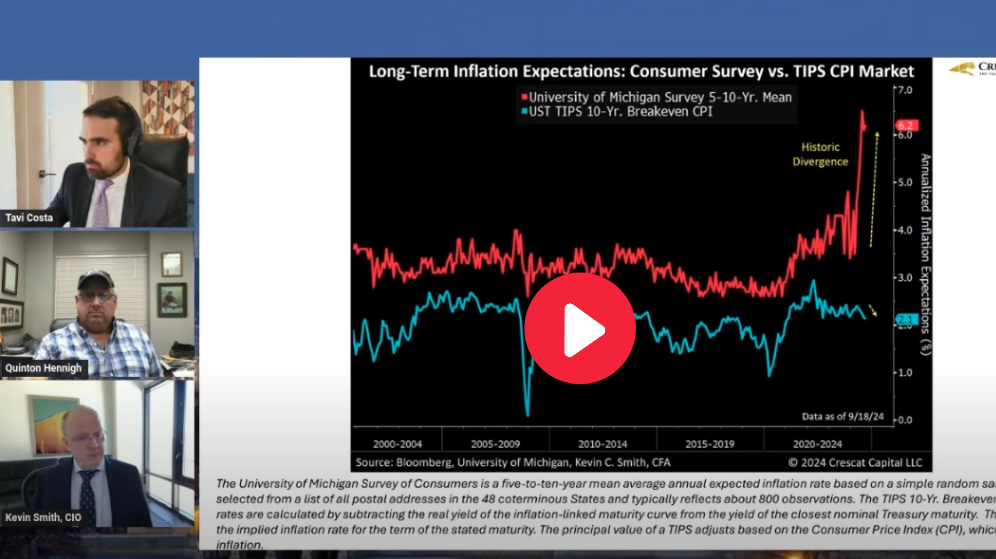

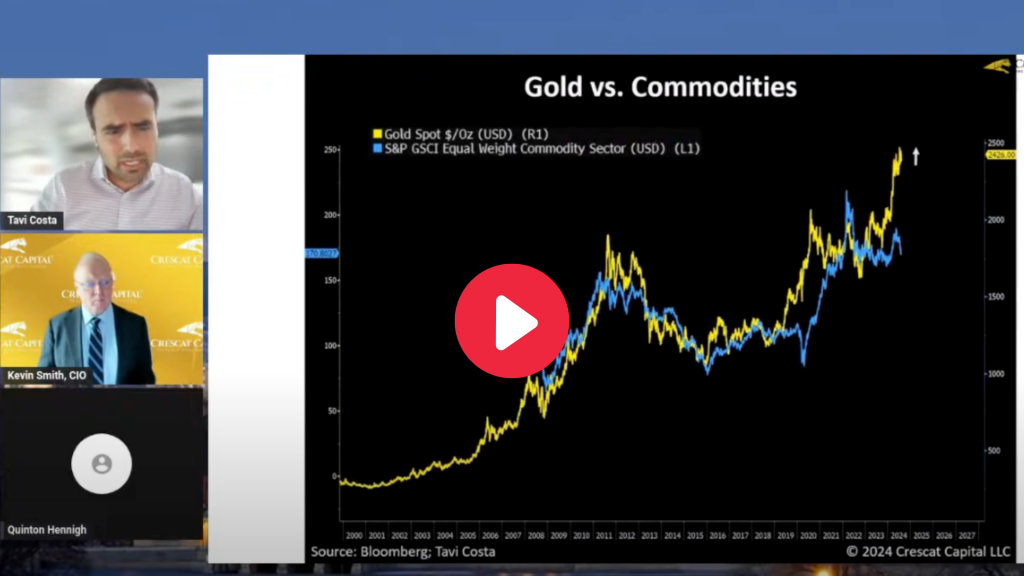

September 20, 2024 - Discusses the ongoing divergence between consumer inflation expectations and government CPI data, highlighting the Federal Reserve’s challenges in controlling inflation. The team also explores the economic implications of yield curve inversions and potential risks of a recession, while reviewing the resilience of energy stocks and metals like gold and copper. The call concludes with updates on mining sector discoveries and exploration, emphasizing new gold and silver targets. Learn More »

Crescat’s Live Market Call – August 16, 2024 Commentary

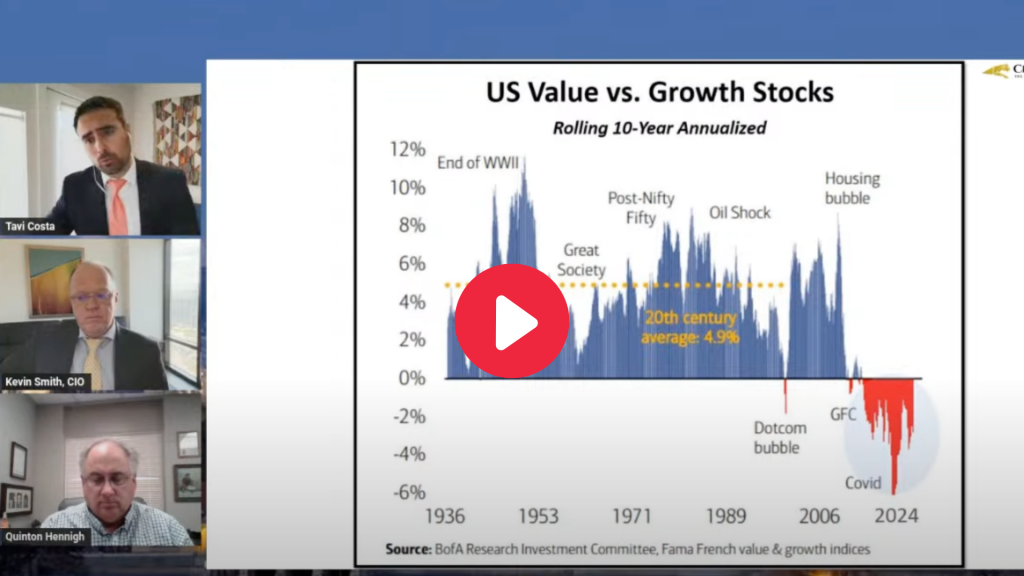

August 16, 2024 - Key topics discussed include the rising S&P 500 price-to-book ratio, the growing divide between cheap value stocks and overvalued growth stocks, total known ETF gold holdings, and gold reaching record highs. Additionally, the video addresses the tech sector's overweight position in the S&P 500 and provides updates on the latest mining and exploration news. Learn More »

Crescat’s Live Market Call – August 9, 2024 Commentary

August 9, 2024 - The video discusses the potential margin exhaustion in mega-cap tech companies and why the Federal Reserve may need to significantly cut interest rates soon. It also compares the performance of the technology and resources sectors within the S&P 500, while examining the relationship between the Fed's balance sheet and the 2-year Treasury yield, providing broader market insights from Crescat Capital. Finally, the team covers important updates that occurred in the exploration mining field this week. Learn More »

Crescat’s Live Market Call – July 26, 2024 Commentary

July 26, 2024 - We believe the two main macro developments since 2020 are the resurgence of inflation and the rise in interest rates. Charts displaying long term inflation expectations and the S&P 500 number of 2% down days jumped in July. From there, Quinton Hennigh provides a detailed update on Snowline Gold and other explorers. Learn More »

Crescat’s Live Market Call – July 19, 2024 Commentary

July 19, 2024 - Discussed the anticipated market shift from large-cap growth to small-cap value stocks and highlighted significant declines in semiconductor stocks. The call also included updates on mining projects, particularly positive drilling results at a few junior explorers, indicating promising mineral intrusions. Learn More »

Crescat’s Live Market Call – July 12, 2024 Commentary

July 12, 2024 - Kevin kicks things off by covering a heat map of the S&P 500, as well as earnings and estimates. From there, Tavi transitions to why we at Crescat believe gold is positioned to breakout, and supports his thinking with various historical examples and current set ups. Finally Quinton wraps things up by covering a plethora of news from the exploration mining industry this week. Learn More »

Crescat’s Live Market Call – July 5, 2024 Commentary

July 5, 2024 - Covering news from long term inflation, employment expectations, and yield spreads. Gold appears to be consolidating after a breakout from a triple top, and Crescat is positioned to capitalize on this pending move upwards. Quinton Hennigh introduces Victoria Gold Corp before diving into recent news. Learn More »

Crescat’s Live Market Call – June 21, 2024 Commentary

June 21, 2024 - Includes updates on Crescat's strategy for helping create new metal deposits and an analysis of the valuation metrics for top S&P 500 stocks, indicating potential overvaluation. Key indicators such as the yield curve steepening are highlighted as recession signals, and the undervaluation of the junior mining industry is emphasized. Learn More »

Crescat’s Live Market Call – June 14, 2024 Commentary

June 14, 2024 - Looking at long-term inflation expectations, and the overvaluation of different stocks, such as Nvidia. As the tech sector approaches tech bubble levels, and Crescat continues to look at historically cheap small cap holdings specifically within the exploration mining sector. Learn More »