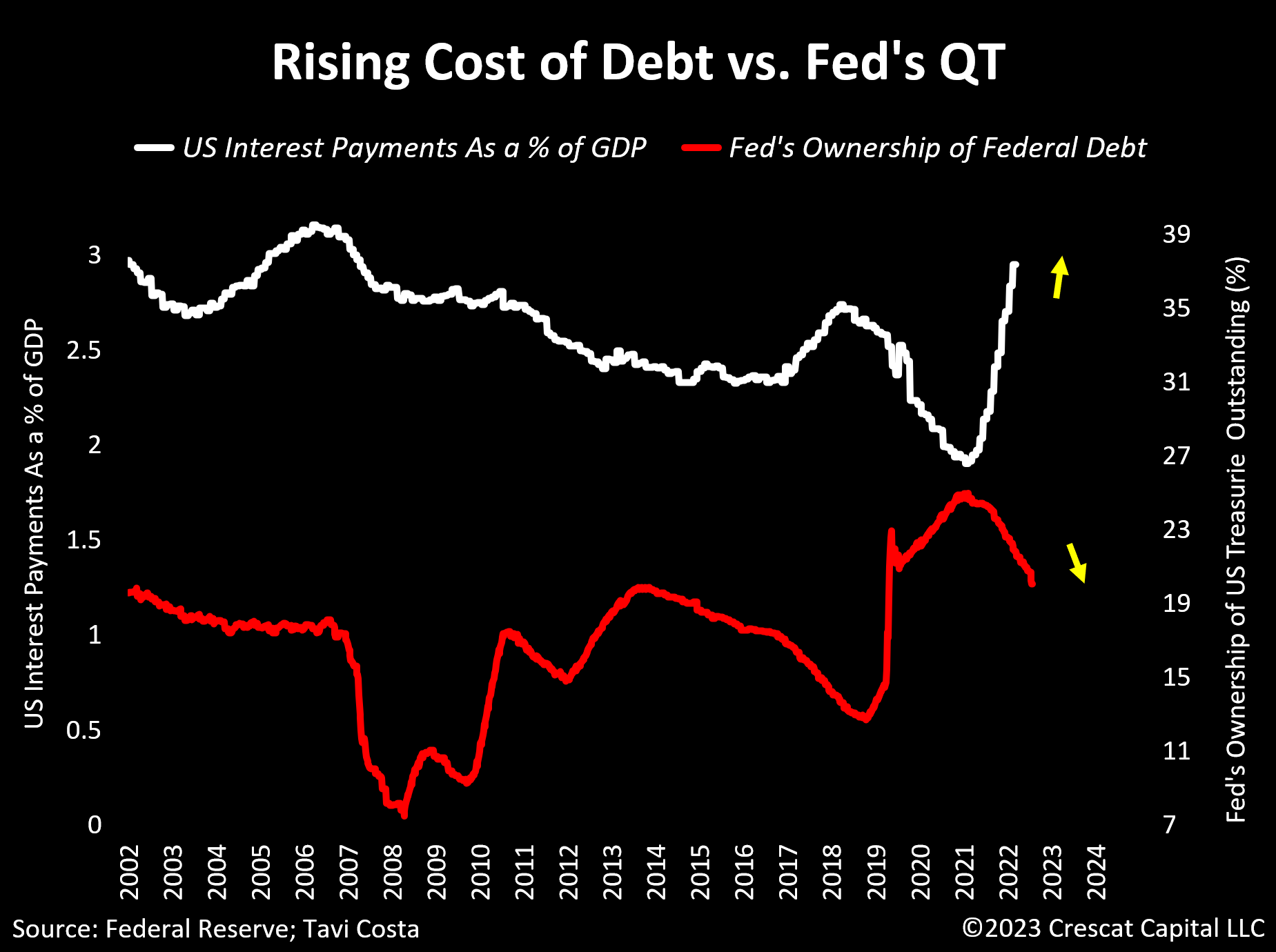

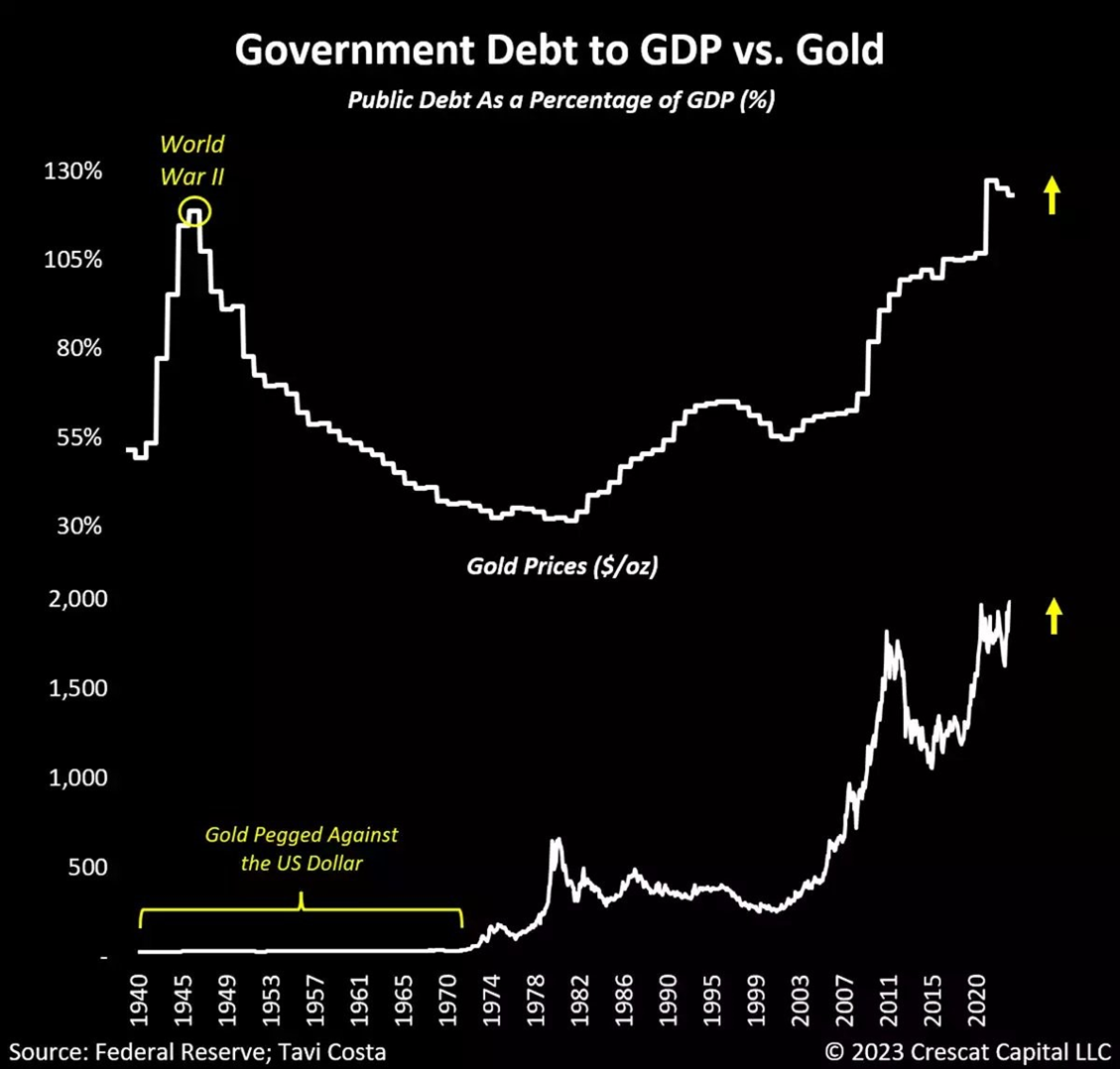

Monetary and fiscal authorities are currently running what we believe are unsustainably divergent policies. The simultaneous rise in the cost of debt by central banks and their deliberate reduction of balance sheet assets is entirely incongruous with the exponential growth in government debt.

Following the COVID era, we have entered a period of fiscal dominance among major developed economies. Hence, the escalating debt burden is already near historical levels and compounding at an alarming pace.

To sustain the current government spending deluge, we believe it is inevitable that the Fed and other monetary authorities reassume their fundamental role as the primary financiers of government debt.

Quantitative tightening policies are the central banks’ own version of an illusionary “debt ceiling”, a disciplinary measure that needs to be consistently reversed in practice.

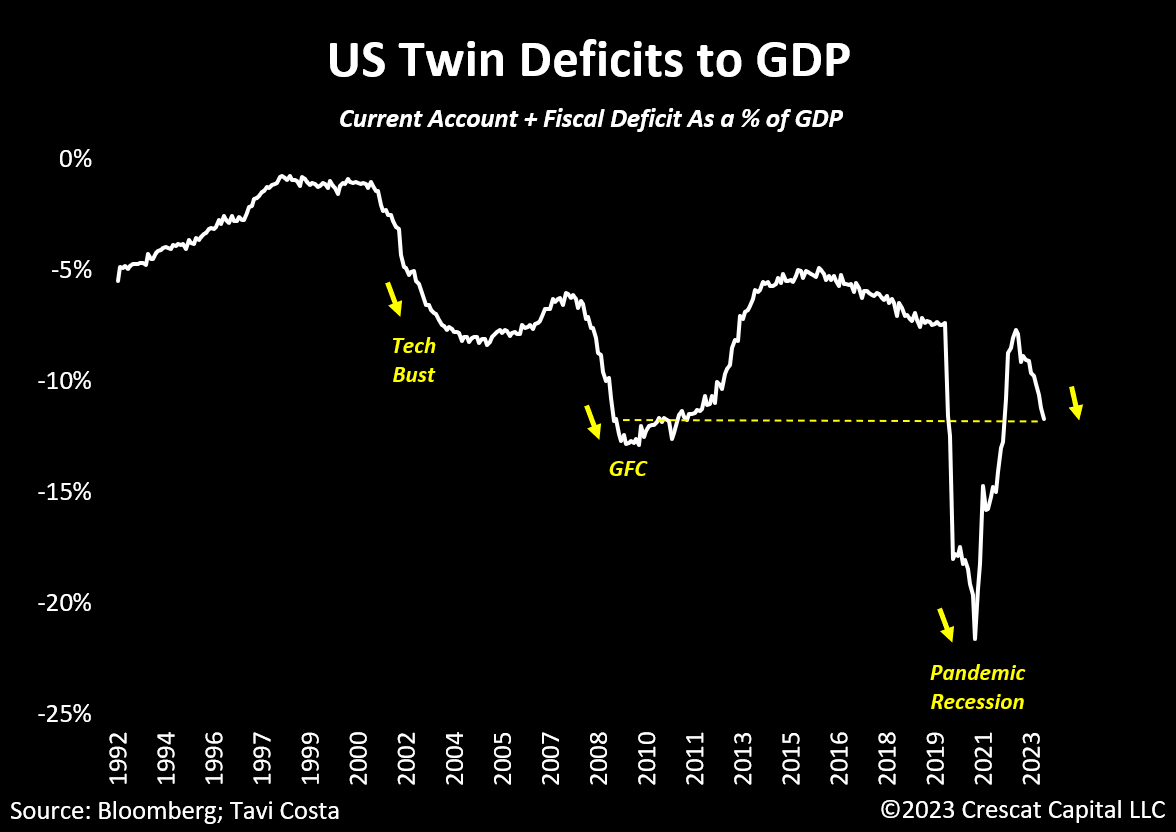

Twin Deficits at GFC Levels

The primary emphasis of our research will be centered on the United States, which is now running twin deficits that are as severe as those experienced during the worst parts of the Global Financial Crisis. This factor has contributed to the recent weakness in the US dollar. However, of even greater concern is the indication that this represents an ongoing structural issue that is still in the process of evolving. Note that with each prior recession, this measurement has reached new lows. This further emphasizes the importance of owning hard assets in this environment.

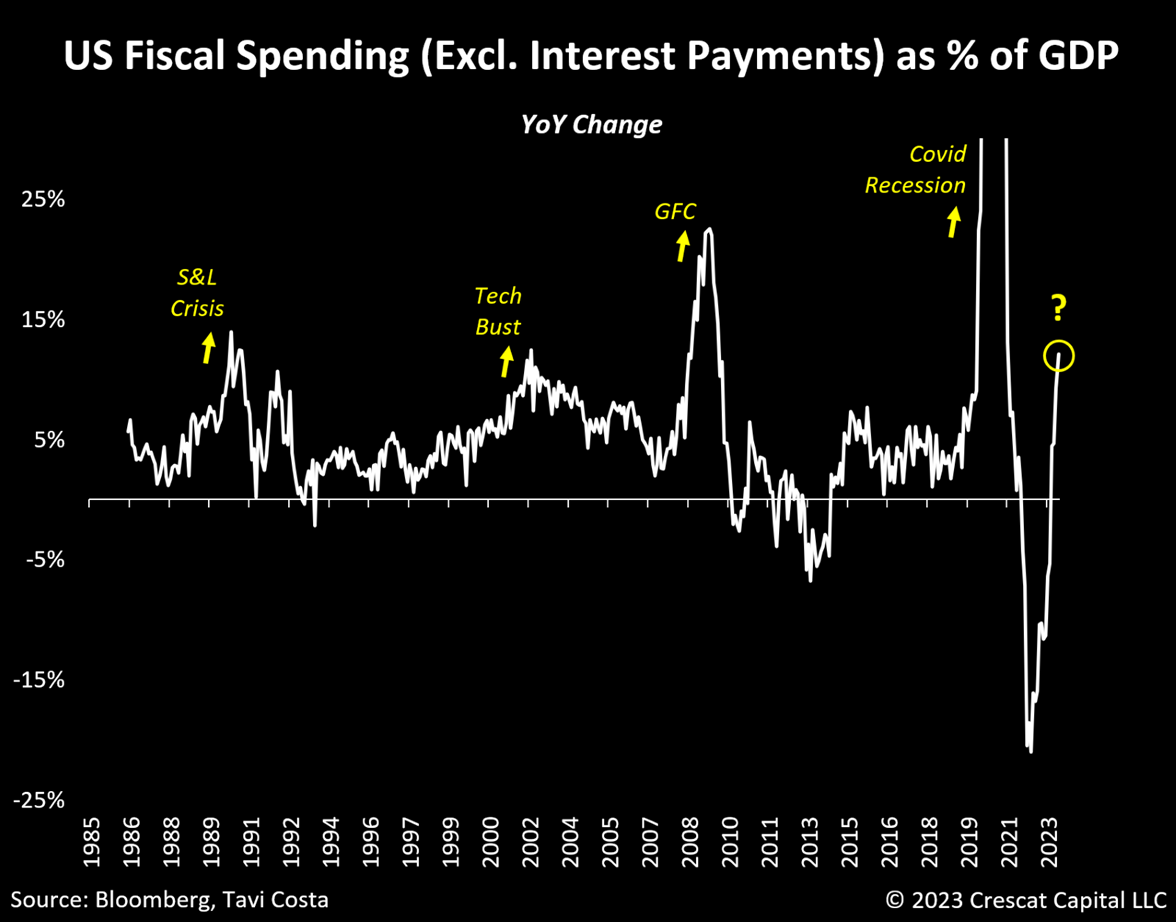

Fiscal Impulse Turning Up

The reality is that the fiscal agenda on a global scale has never been more expansive. While today’s severe inequality and wealth-gap issues have led to larger government social programs compared to historical norms, rising geopolitical tensions further exacerbate the issue. Countries acknowledge the significance of bolstering defense spending and the crucial need to reduce interdependence among trading partners by revitalizing domestic manufacturing capacities. Alongside this trend of reindustrialization, particularly among G-7 economies, governments persist in advocating for a substantial green-energy revolution, which necessitates a significant infrastructure overhaul.

Indeed, in the US, the impact of such high levels of government expenditure is evident in the data. Excluding tax receipts, which have declined to levels comparable to those seen during recessions, fiscal spending alone represents a substantial 25.4% of nominal GDP in the US. That is higher than what we experienced after the global financial crisis or any other crisis in history outside of the Covid recession when the economy was in full lockdown.

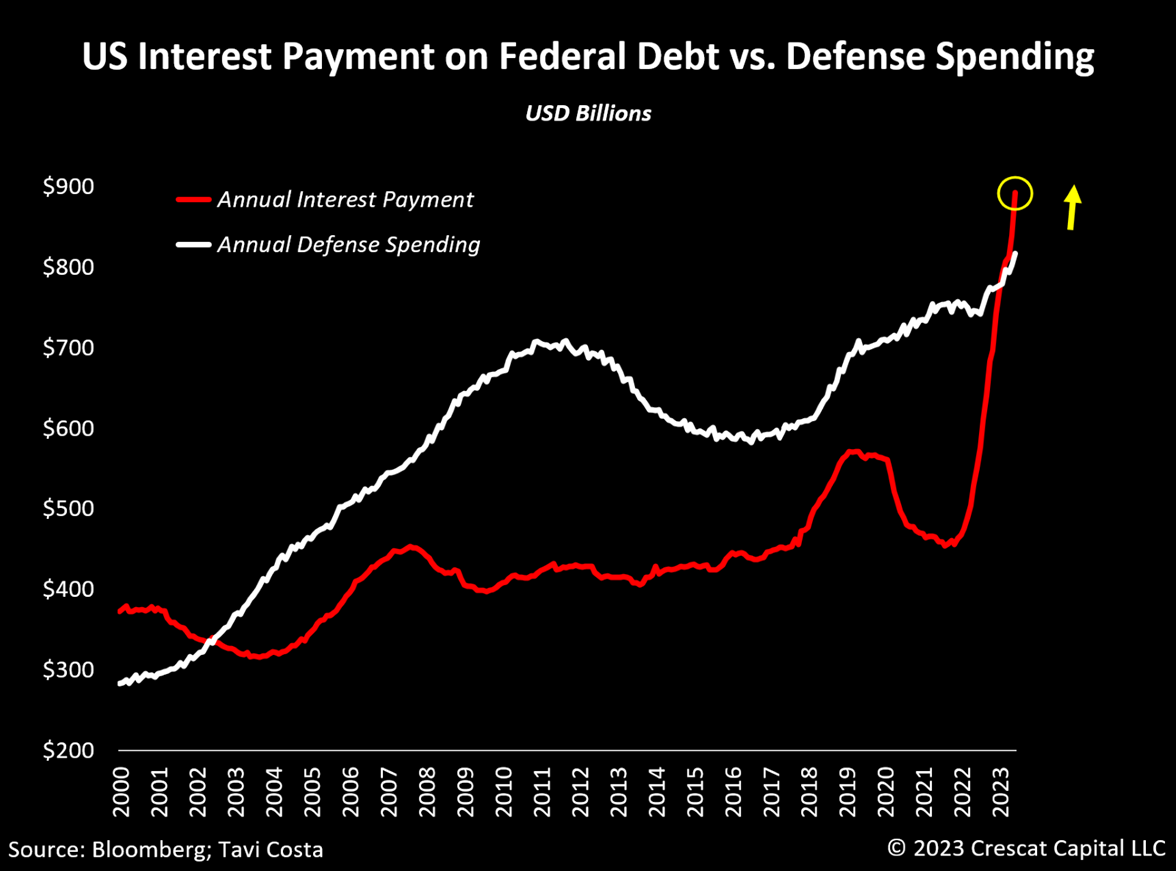

While interest payments are growing exponentially, that still contributes to a relatively small percentage of the overall fiscal outlays. To be specific, it accounts for less than 10% of it. Interest payments used to be close to 15% of government spending in the 1980s and 1990s when interest rates were higher. This number is set to undergo a substantial increase and has the potential to create a larger problem soon.

Nonetheless, the US fiscal impulse has turned positive in a significant way recently, especially when calculating net of interest payments, which is now up 12% on a year-over-year basis.

In a healthy economic growth environment tax revenues typically increase while government spending tends to decline. However, today’s situation is a complete reversal of this trend.

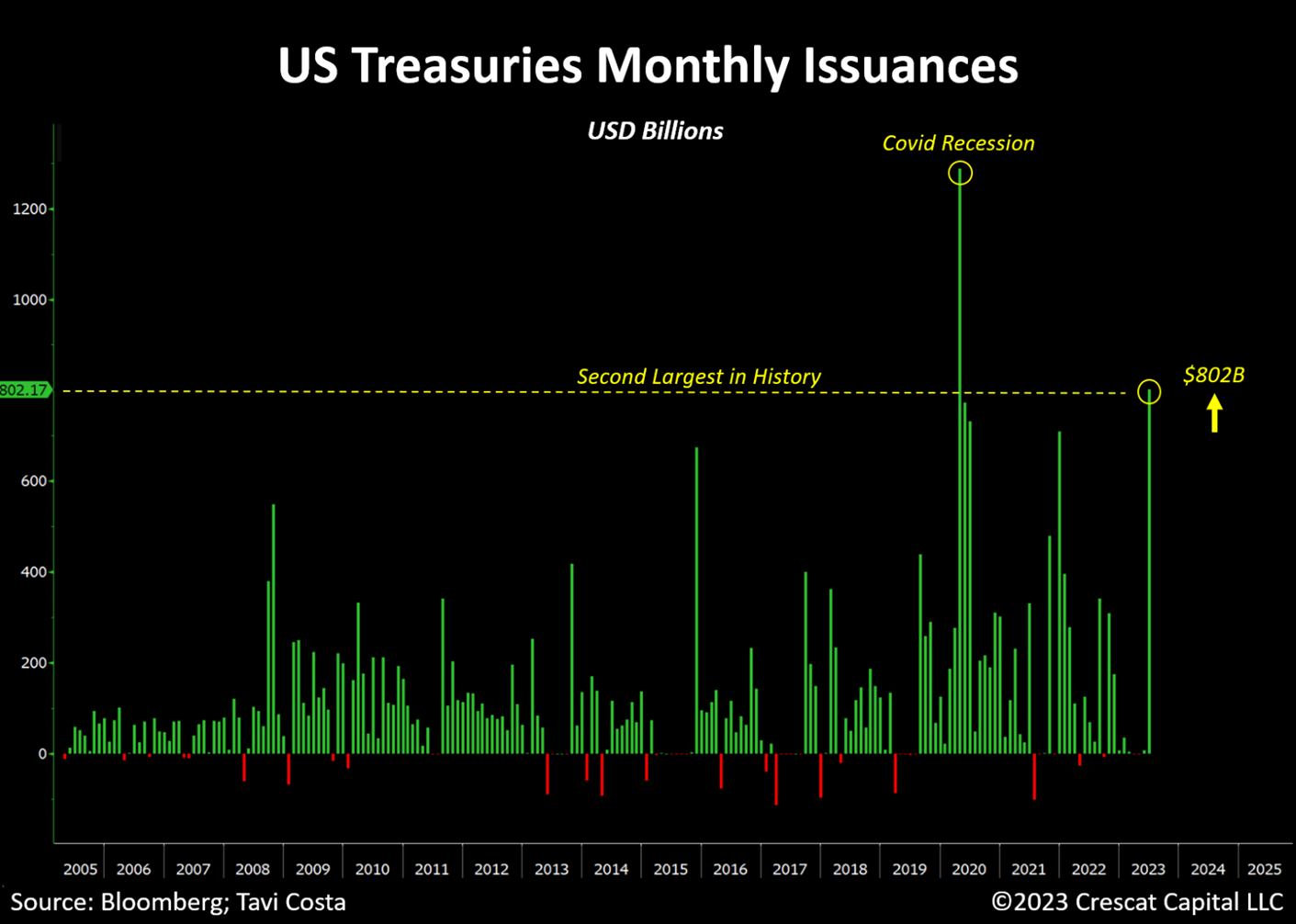

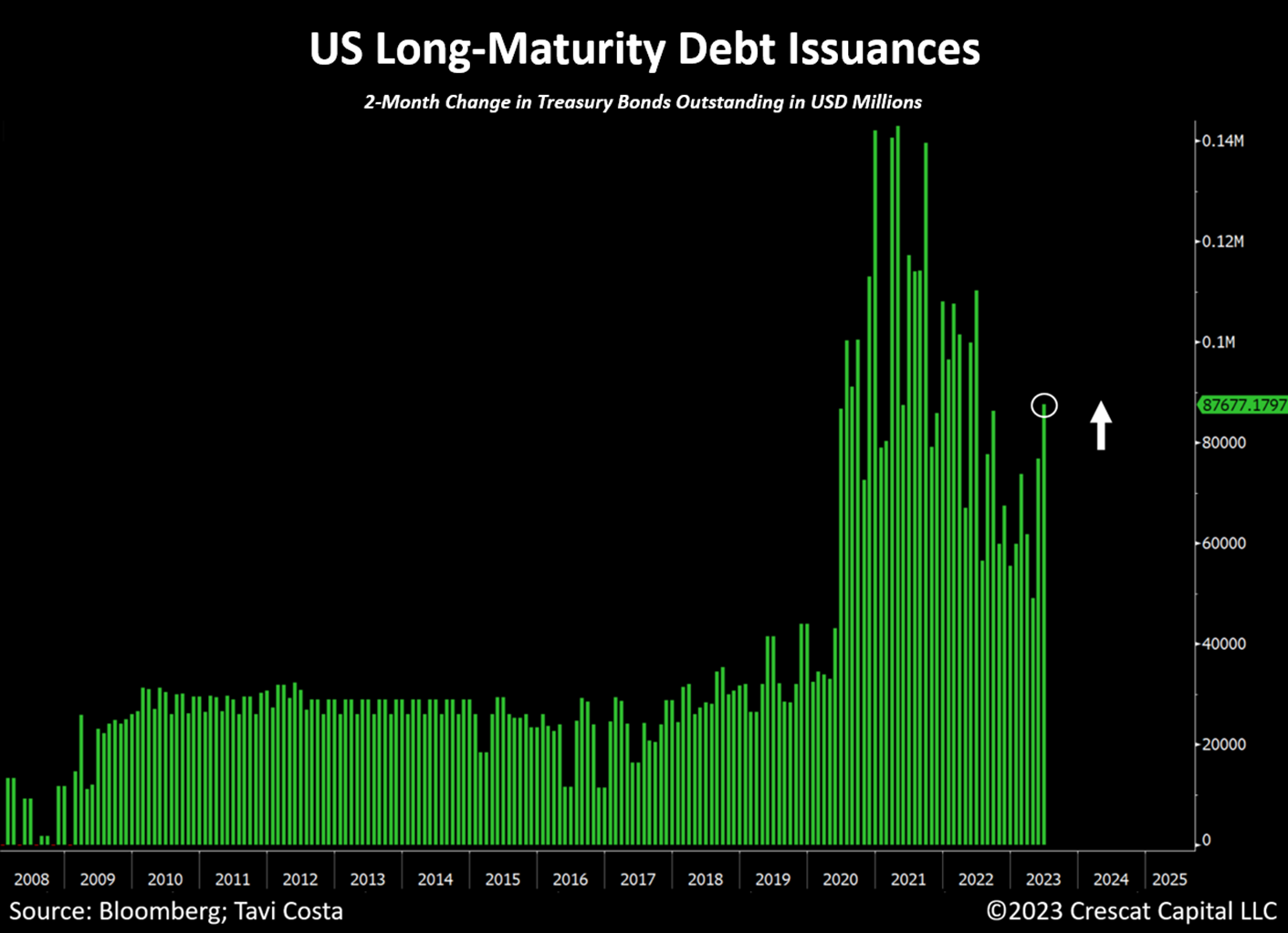

Second-Largest Issuance in History

The US is currently operating as if it were facing another pandemic lockdown from a fiscal spending and debt issuance perspective, yet there is one critical difference. Rather than the Fed financing over 50% of newly issued Treasuries, they are shrinking their balance sheet assets at the fastest pace in history.

It is important to consider that, unlike during the recovery from the global financial crisis, other central banks have not been buying these government bonds either. In fact, foreign holders currently own only approximately 20% of all outstanding Treasuries, marking the lowest level in nearly two decades.

Following the resolution of the debt ceiling agreement, the US government has already issued more than $1 trillion worth of US Treasuries. Notably, the month of June witnessed the second-largest issuance in history.

Not Only Short-Maturity Treasuries

As anticipated by the market, a significant portion of these issuances is comprised of T-Bills, which are short-term maturity instruments. However, what seems to be off the radar is the fact that there has also been a substantial issuance of longer-duration Treasuries in recent months. The significant increase in the overall supply of these sovereign instruments is exerting additional pressure on long-term yields, contributing to their ongoing rise.

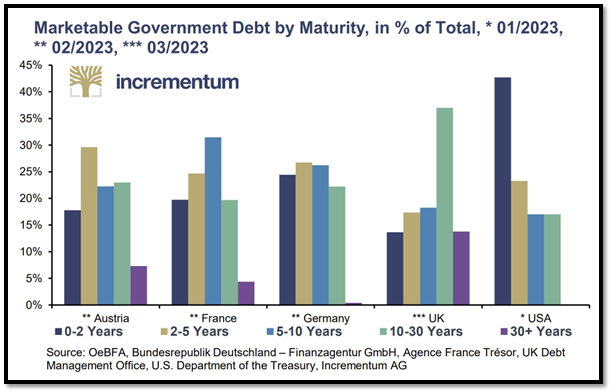

Nearly Half of the Federal Debt Matures in Two Years

To reiterate, although US interest payments represent less than 10% of the overall fiscal outlays, these obligations are likely to surge even further in the next couple of years. Here is one main reason for that:

The US will need to refinance almost half of its national debt in less than 2 years. As a reminder, interest rates were at 0% just 15 months ago.

If the government decides to reissue these maturing Treasuries in short-duration instruments, as it did recently after the debt ceiling agreement, these obligations will need to be rolled over at over 5% interest rates.

Surging Cost of Debt

While the US government is shifting focus to boost military expenditures from historically depressed levels, the current interest payments on the Federal debt have already exceeded annual defense spending. This is likely the initial stages of a trend, and if no solutions are implemented, other components of the fiscal agenda may soon be constrained by the escalating cost of debt.

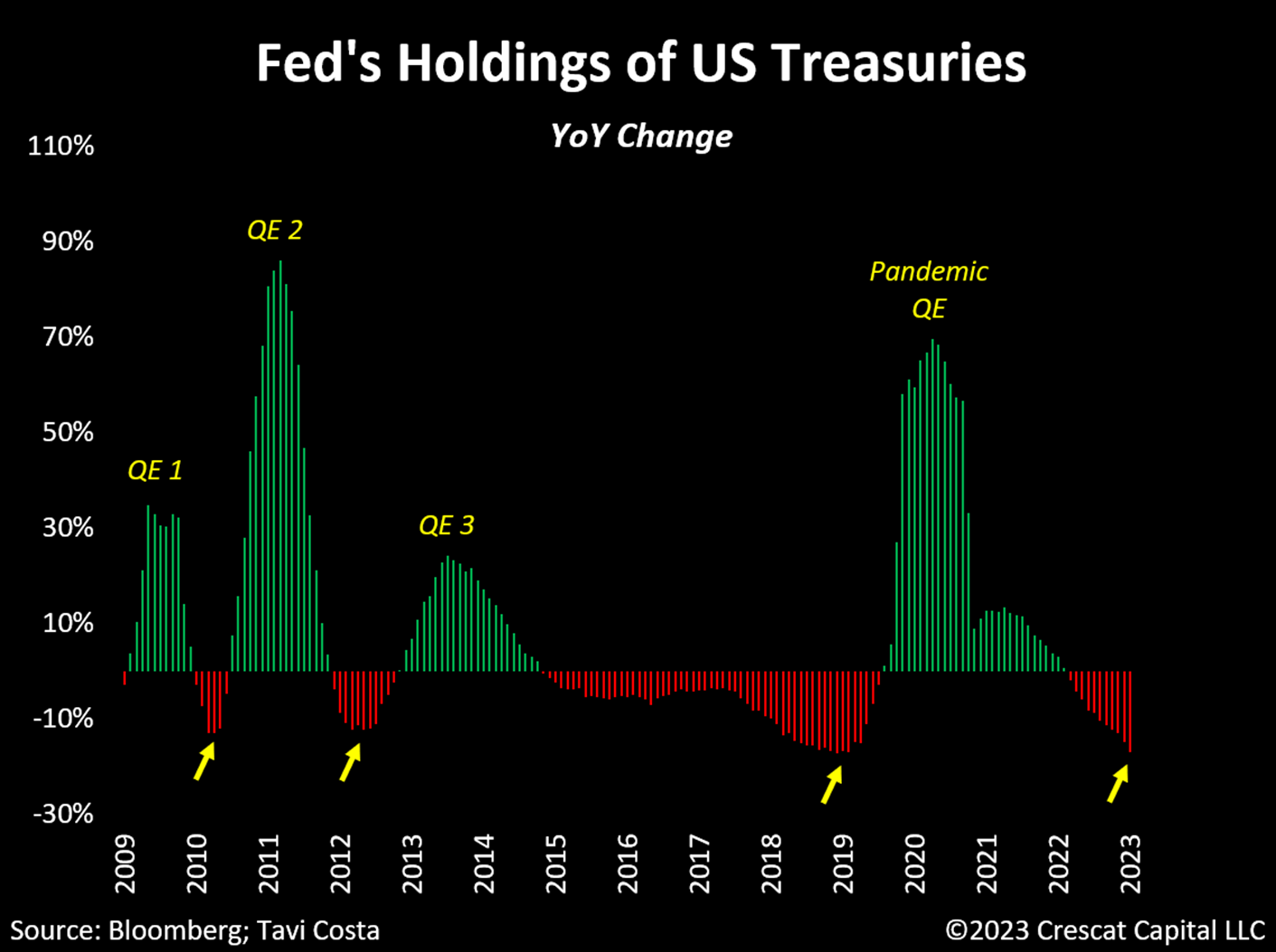

Yield Curve Control: A Matter of Time

The notion of an “improving” economy being linked to rising yields seems completely ludicrous in our view. The US debt problem is not only at staggering levels but is also compounding at almost 10% annually, while the Fed continues to shrink its Treasury holdings at a record pace. What gives?

Based on the rate-of-change analysis, there has been a 17% decline in the Fed’s holdings of US Treasuries. Interestingly, historical patterns suggest that similar balance sheet contractions have led the Fed to eventually reverse its policy.

Given the current magnitude of Treasury issuances flooding the market today, resulting in upward pressure on long-term yields, we believe that unspoken political pressure to implement “yield curve control” policies is already beginning to swell. The Fed’s inclination to implement such policies may only exist if the economy is in a recession, which we think is the path of least resistance today.

Gold: An Escape Valve

Investing in gold implies wagering on the notion that the debt problem will deteriorate further from its current state.

The 1940s period was a compelling historical analogy to today given the severity of the current debt problem. However, there is one major distinction that is often ignored. During that time, the US dollar was effectively tied to gold prices, making the metal an unfeasible investment alternative.

Today, with prices unpegged, it is highly probable that capital will divert away from US Treasuries and flow into gold. This becomes particularly crucial at a time when the government continues to issue a flood of debt instruments into the market after agreeing to extend the debt limit.

Today the metal is likely to serve as an escape valve for those seeking the ultimate form of protection during times of debt and monetary crises.

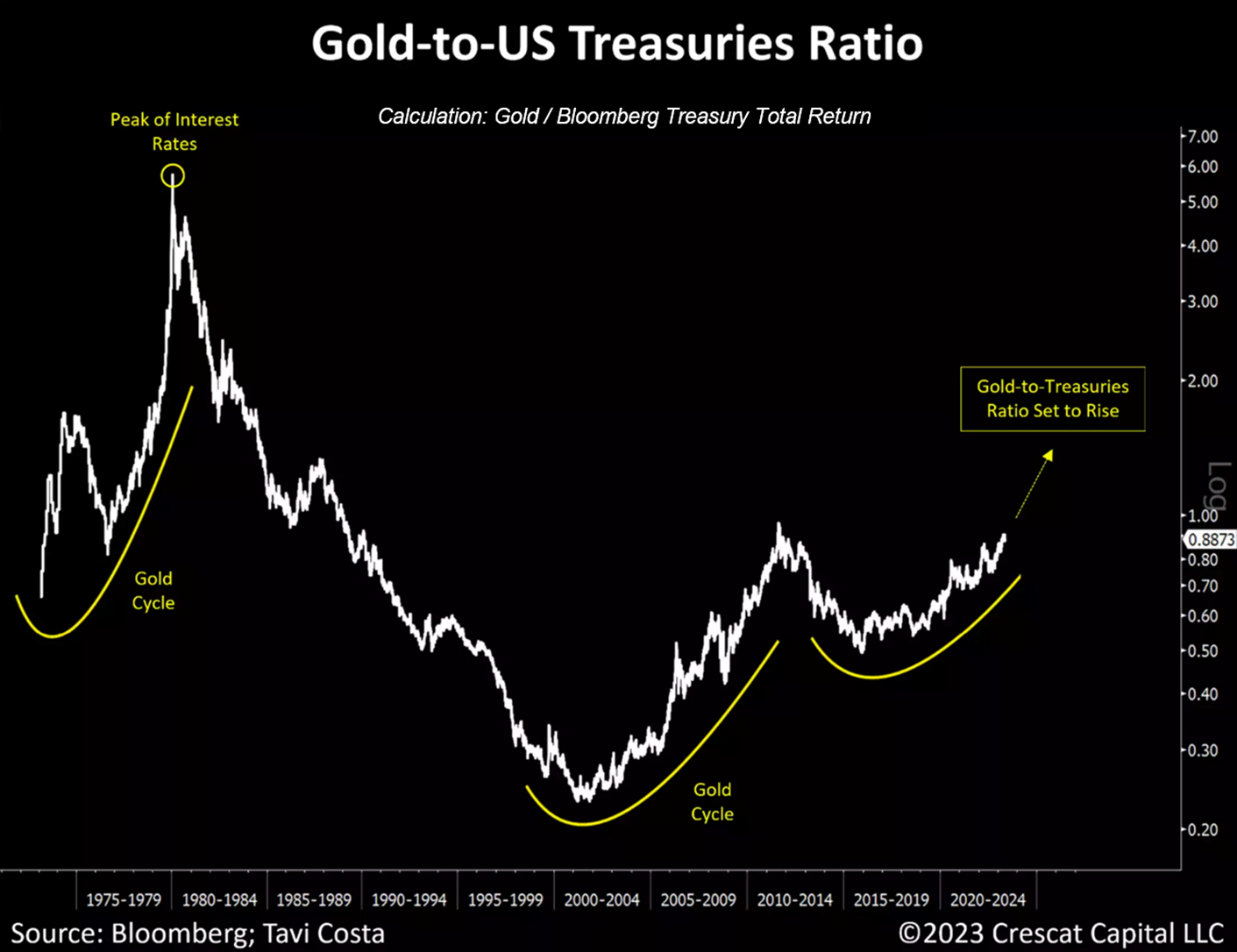

Gold > Treasuries

If the rationale for owning US Treasuries today is solely based on the premise that the system cannot endure substantially higher interest rates, then gold is a far superior choice. It’s a neutral asset with no counterparty risk that also carries centuries of credible history as a haven and monetary alternative.

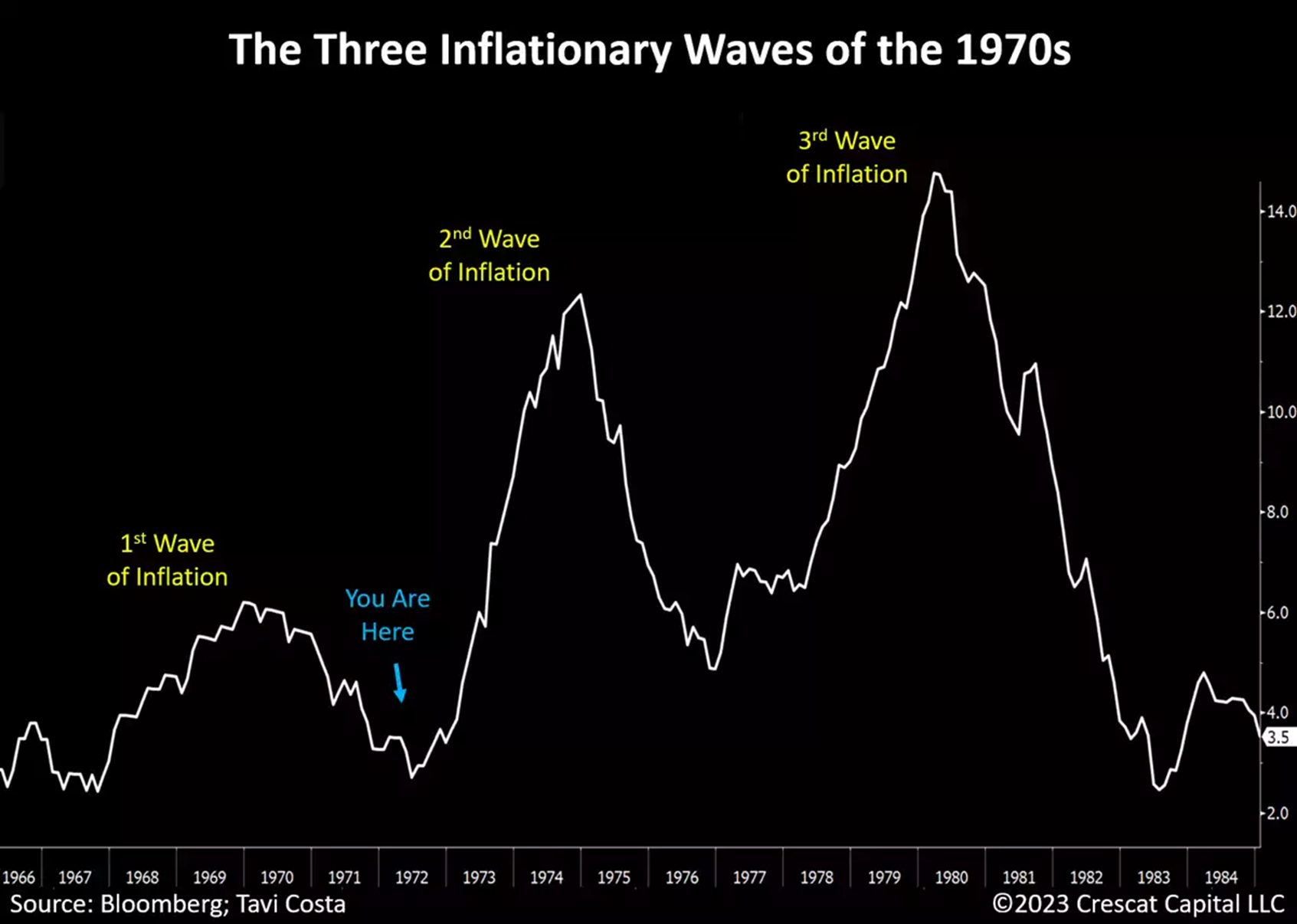

Inflation in a Bottoming Process

Just as base effects played a crucial role in reducing inflation rates, we anticipate that the opposite effect is on the horizon, with Consumer Price Index (CPI) likely to reach a bottom in the near future.

Last week’s CPI report marked a significant milestone as it is the first time in 102 years that we have witnessed twelve consecutive months of declining CPI on a YoY basis. The last time we experienced such a situation was in 1921 after the Spanish Flu pandemic, which marked the actual bottom for inflation rates at -15.8%. Today, after the same monthly sequence of falling CPI, the rate is still positive and above the Fed’s target.

The overwhelming focus on the recent slowdown in inflation appears to be rooted in backward-looking analysis. In fact, since last week’s CPI report, oil has broken out, gold rallied back above $2,000, silver surged, and agricultural commodities appreciated substantially.

While the macro environment today differs from that of the 1970s or 1940s, a lesson from history remains: inflation tends to develop in waves. We have recently witnessed the conclusion of the first wave and are likely in the process of reaching a bottom in the recent deceleration period, with a new upward trajectory underway. The primary reason for this is the persistence of underlying structural issues that continue to drive inflation rates higher:

- Wage-price spiral, particularly driven by low-income segments of our society

- Ongoing supply constraints due to chronic underinvestment in natural resource industries

- Irresponsible levels of government spending

- Escalating deglobalization trends, which necessitate the revitalization of manufacturing capabilities in economies.

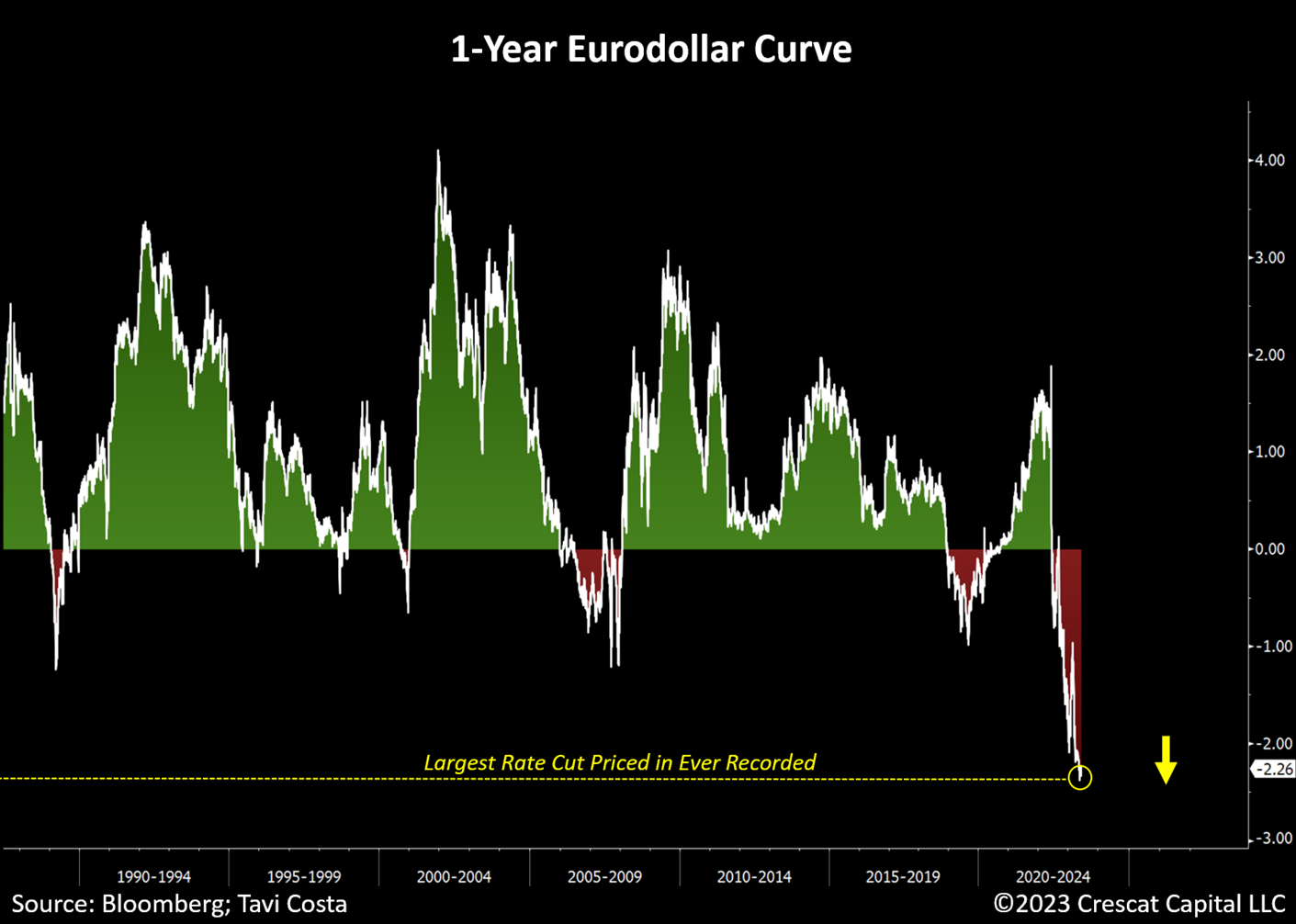

Interest Rate Cut Expectations: A Crowded Consensus

It is worth highlighting that, despite the strong potential for inflation rates to be in the process of bottoming out, the Eurodollar curve is currently pricing in the largest interest rate cuts in the history of the contract for the next year. Investors are highly likely to be caught off guard as CPI starts to accelerate again, leading the US monetary authorities to maintain higher Fed funds rates for longer and even engage in additional rate hikes in the short turn until its recessionary goals can be more clearly accomplished.

The Upside Case for Oil

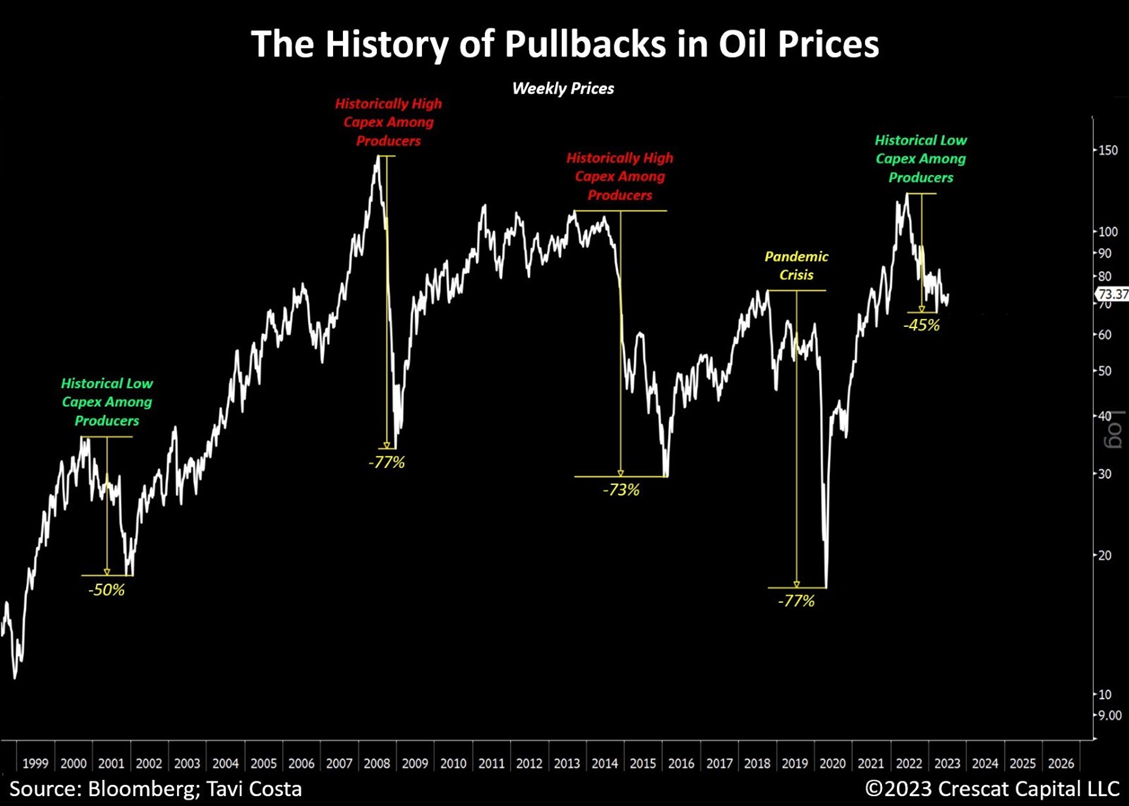

After being down 45% from its recent highs, the risk/reward to buy oil today appears heavily skewed towards the upside. Excluding the outlier event of the pandemic crisis, we can observe two types of pullbacks in oil prices over the past few decades:

• The GFC and the 2014 energy market meltdown resulted in an average decline of approximately 75% from peak to trough.

• During the tech bust, the decline was close to 50%

In the current environment, we believe there are strong similarities to the early 2000s period, particularly in terms of historically depressed capital spending. Despite the risk of a demand shock, which is already largely reflected in the current prices, in our view, oil supply remains incredibly tight with production still below pre-pandemic levels. Unlike a year or two ago, the government has already depleted its strategic petroleum reserves to levels not seen since the 1980s.

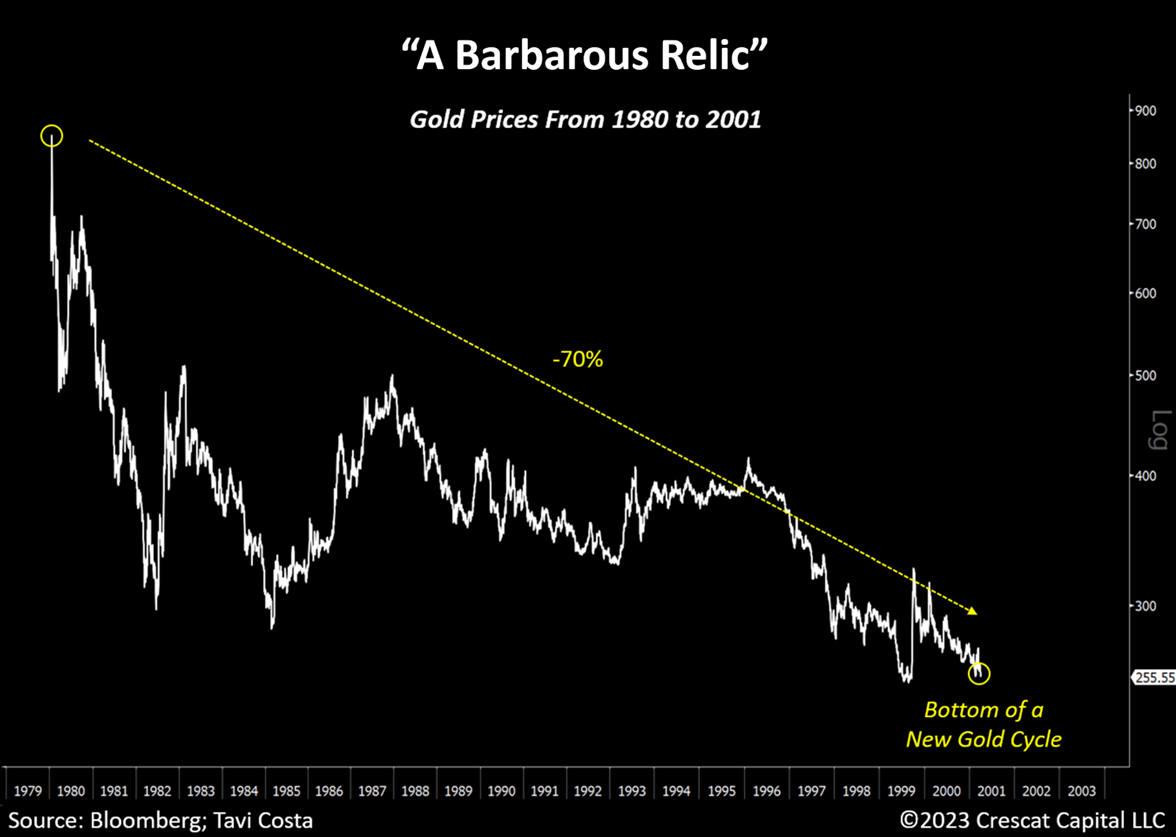

Gold: “A Barbarous Relic”

The current skepticism surrounding gold brings back memories of the late 1990s when equity markets soared due to the excitement surrounding the emergence of the Internet. During that time, gold prices experienced a significant decline of over 70% in 21 years, underperforming almost every other asset class (first chart below). Some less experienced investors even labeled the metal as a barbarous relic.

However, markets often defy conventional expectations, and that period marked the bottom for gold prices, initiating a new long-term uptrend, propelling gold into a secular bull market that lasted over a decade.

Following the mentioned period, gold prices embarked on a remarkable upward trajectory, delivering one of the most impressive performances in its history (see the second chart below). Notably, silver significantly outperformed gold during this period, leading to a substantial decrease in the gold-to-silver ratio from 81 in 2003 to 31 in 2011.

Based on these historical trends, we maintain a strong conviction that we are on the brink of entering another enduring bull market for gold, with silver anticipated to spearhead the upward movement.

Precious Metals Primed for a Historical Breakout

Despite gold being within 5% of its all-time highs, skepticism towards the metal remains prevalent. A key turning point occurred in September 2022 when the Wall Street Journal published an article titled “Gold Loses Reserve Status” on its front page, leading to a short-term bottom in gold prices. Subsequently, precious metals experienced a strong rally and recently formed a triple top, testing previous highs from August 2020 and the peak during the Russia-Ukraine invasion.

In recent weeks, Bloomberg also published an article headlined “Gold Is No Longer a Good Hedge Against Bad Times,” at almost precisely the wrong time. Since then, precious metals have had another relevant move on the upside.

We believe that a potential breakout to new levels could attract substantial capital inflows to the mining industry, which has been starving for capital.

The Cheapest Metal on Earth

Silver looks ready to break through its decade-long resistance this month. One thing is likely to be true, if this is indeed the onset of a new gold cycle, none of us own enough silver.

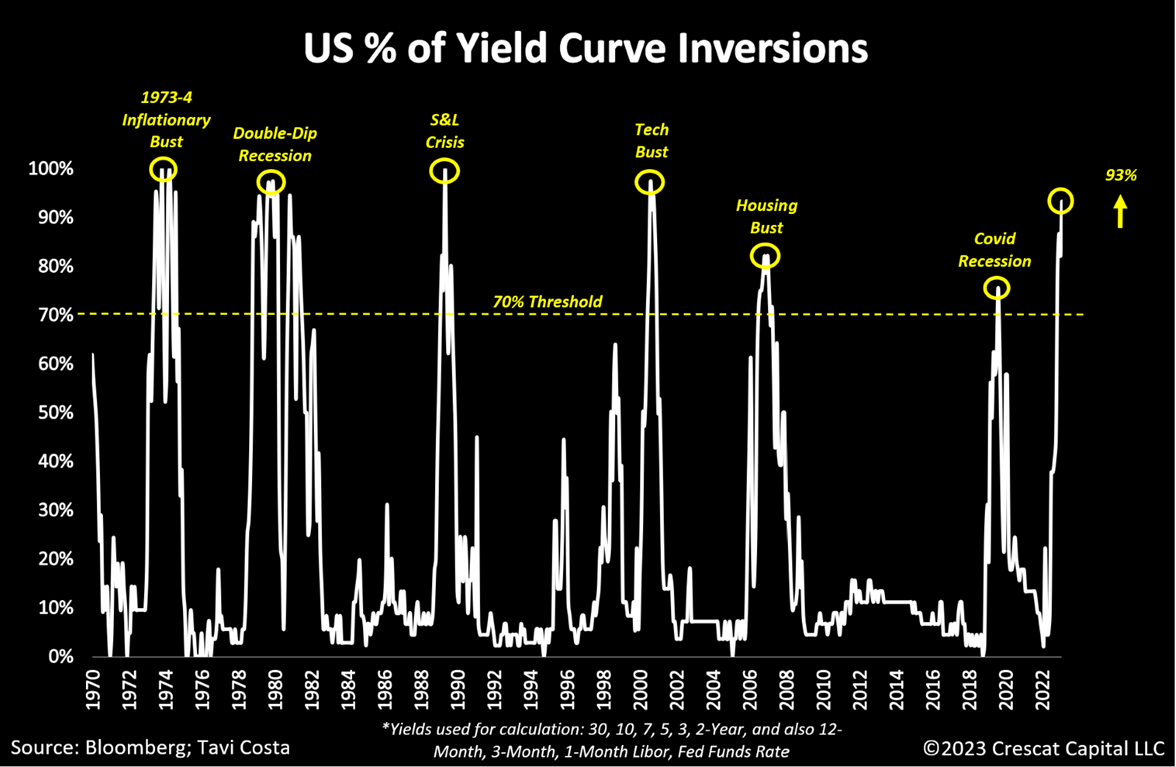

Key Signals of Stagflationary Times Ahead

It is hard to be structurally bullish on the economy when almost the entire Treasury curve is inverted, despite the fact that yields across the board, short and long-term, have been increasing. The tech bust and the global financial crisis certainly didn’t unfold in this manner. During those times, it was the collapse of long-term yields that led to a surge in inversions.

Today’s issue in the Treasury curve resembles prior stagflationary times with yields across all durations continuing to move higher.

Overall equity market valuations are completely out of line with an environment where the cost of capital for businesses remains on the rise, accompanied by an increasing risk of a severe economic downturn. Let us not forget that monetary policy works with a lag, and the Fed has been tightening financial conditions for almost 16 months now.

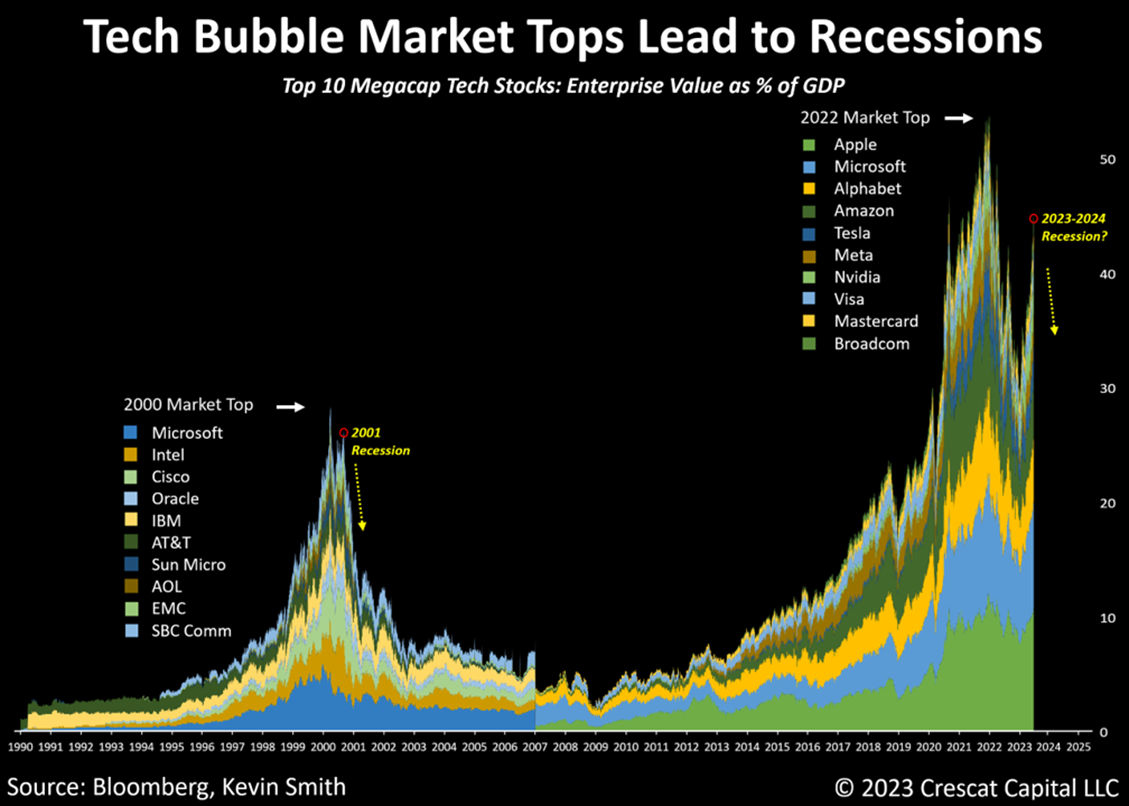

A Euphoria-Driven Rally in Equity Markets

Meanwhile, the valuation of US equity markets continues to defy logic, with completely delusional fundamental multiples. Since the market peaked, Nasdaq has been significantly impacted by the increase in interest rates. Despite the continuous upward movement in 10-year yields, this correlation has been disrupted by the euphoria surrounding AI and consequently the surge in mega-cap tech companies. We believe the present value of long-duration businesses must soon start to better reflect the ongoing rise in discount rates with irrationally exuberant investors bearing the brunt of the punishment. While these mispriced financial assets declined in 2022, they have only been reflated in 2023. We have yet to see the true bursting of financial asset bubbles that would correspond with the onset of a recession. From a valuation perspective, the excesses still rival those of 1929 and 2000.

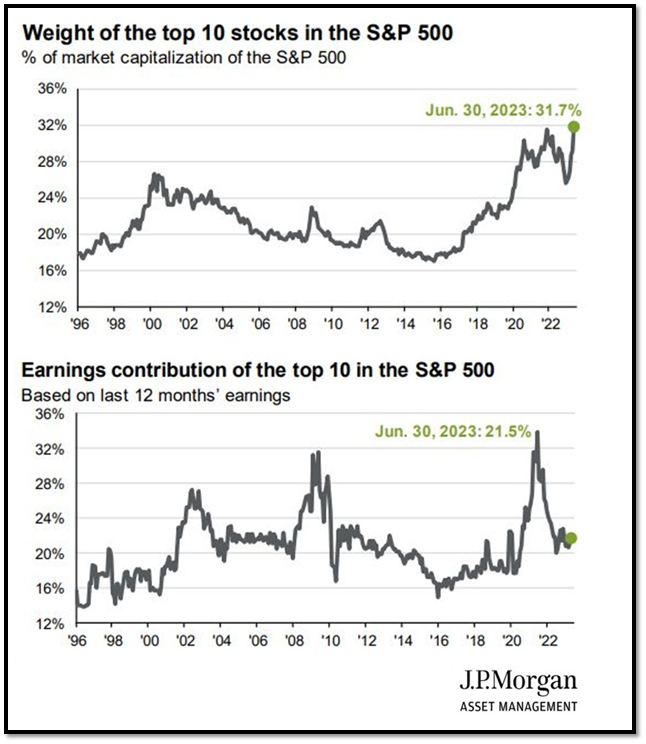

The “Magnificent” Top 10

Even though the combined market capitalization of the top 10 companies in the S&P 500 constitutes an unprecedented 31.7% of the index, their earnings contribution has been drastically declining and now stands at only 21.5%.

The dominance of megacaps in leadership is overwhelmingly unsustainable and cannot be justified by their current fundamentals.

Recent Rally Not Justified by Fundamentals

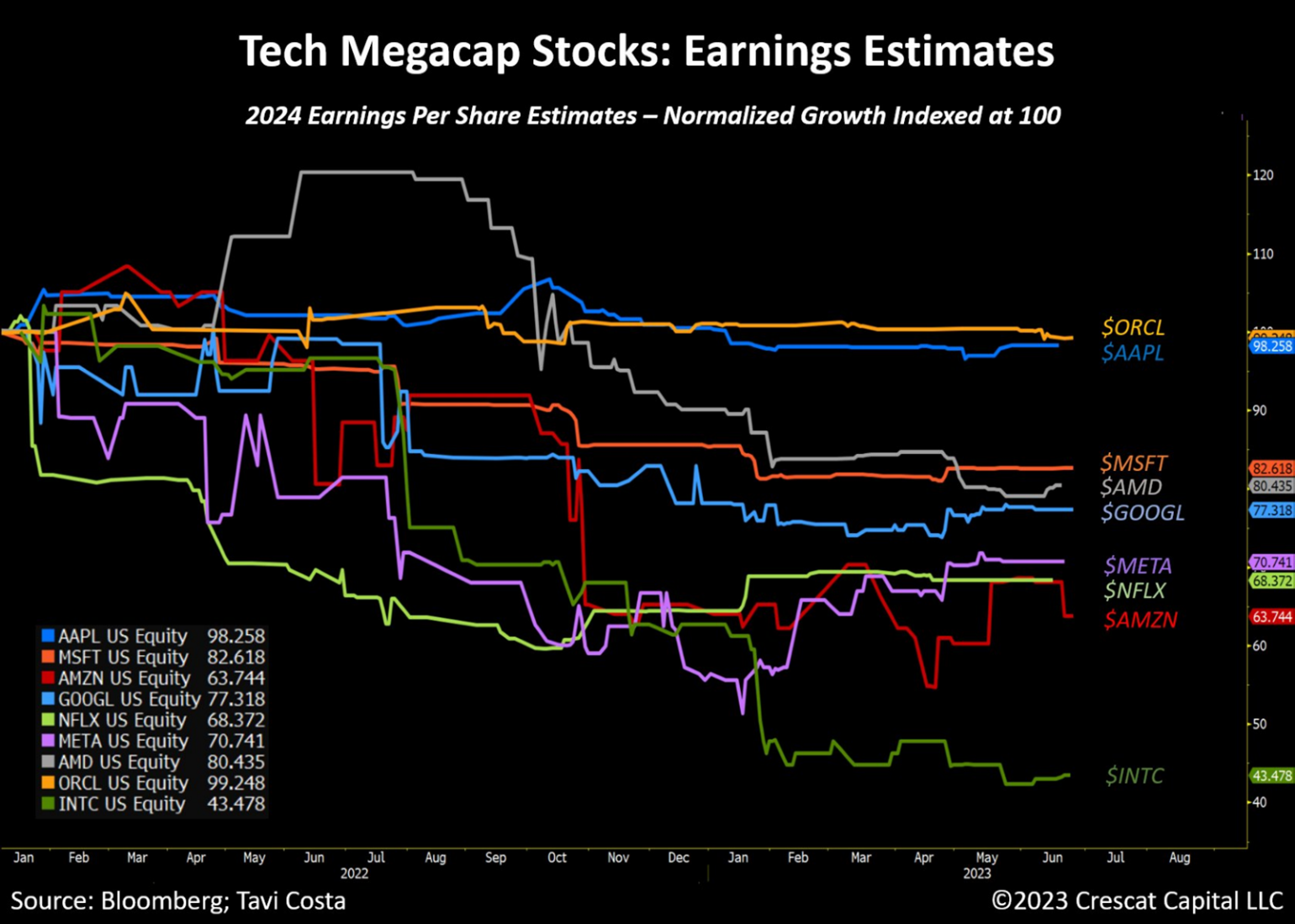

It is intriguing how the recent rise in tech megacap stocks has not been accompanied by a corresponding growth in projected earnings, despite the enthusiasm surrounding AI. In reality, we have seen the opposite of that in some cases. With the exception of $NVDA, tech megacap companies have either experienced stagnant growth in expected 2024 EPS (Earnings Per Share) or a substantial decline.

The persistently elevated cost of capital, coupled with the current excessive valuations and narrow market leadership, continues to be a cause for great concern. Considering the ongoing major Treasury issuances as the Fed shrinks its balance sheet, these stocks are clearly priced for perfection.

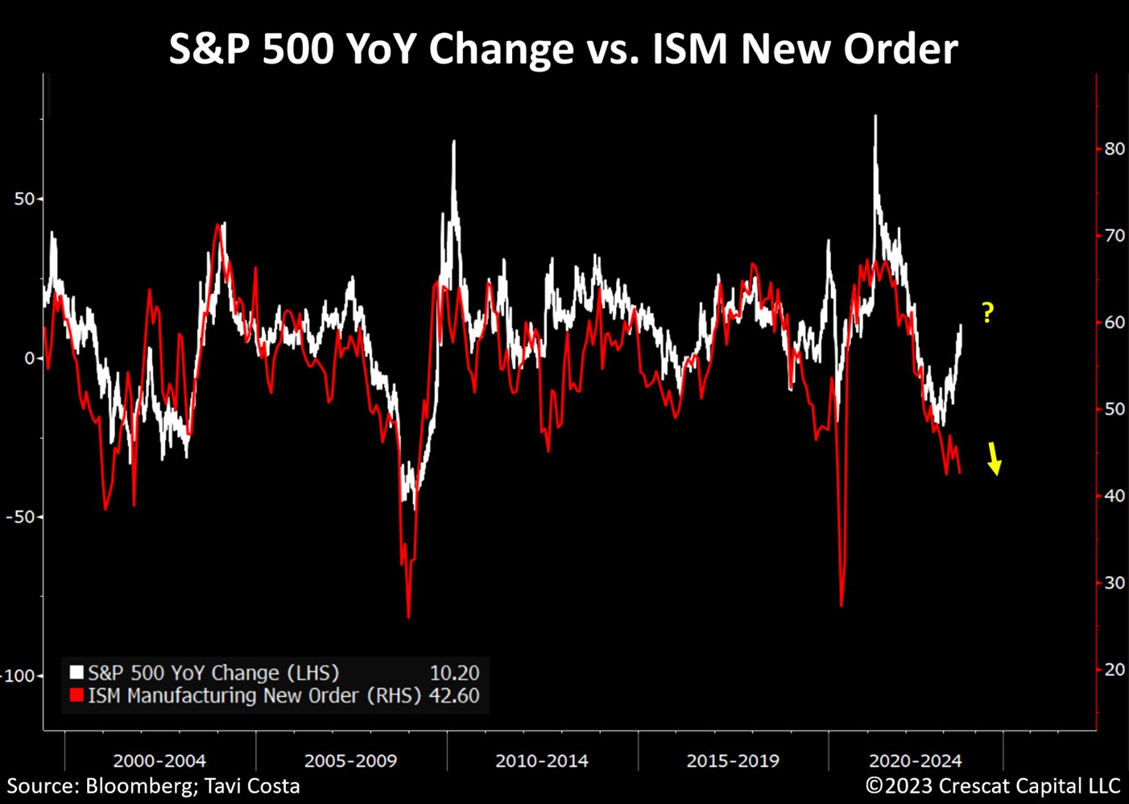

A Critical Divergence

The year-over-year change in the S&P 500 is now diverging from the ISM New Orders index. Note that the last time this happened preceded the volatility event we had during the March 2020 crash and recession.

An Attractive Segment of the Market

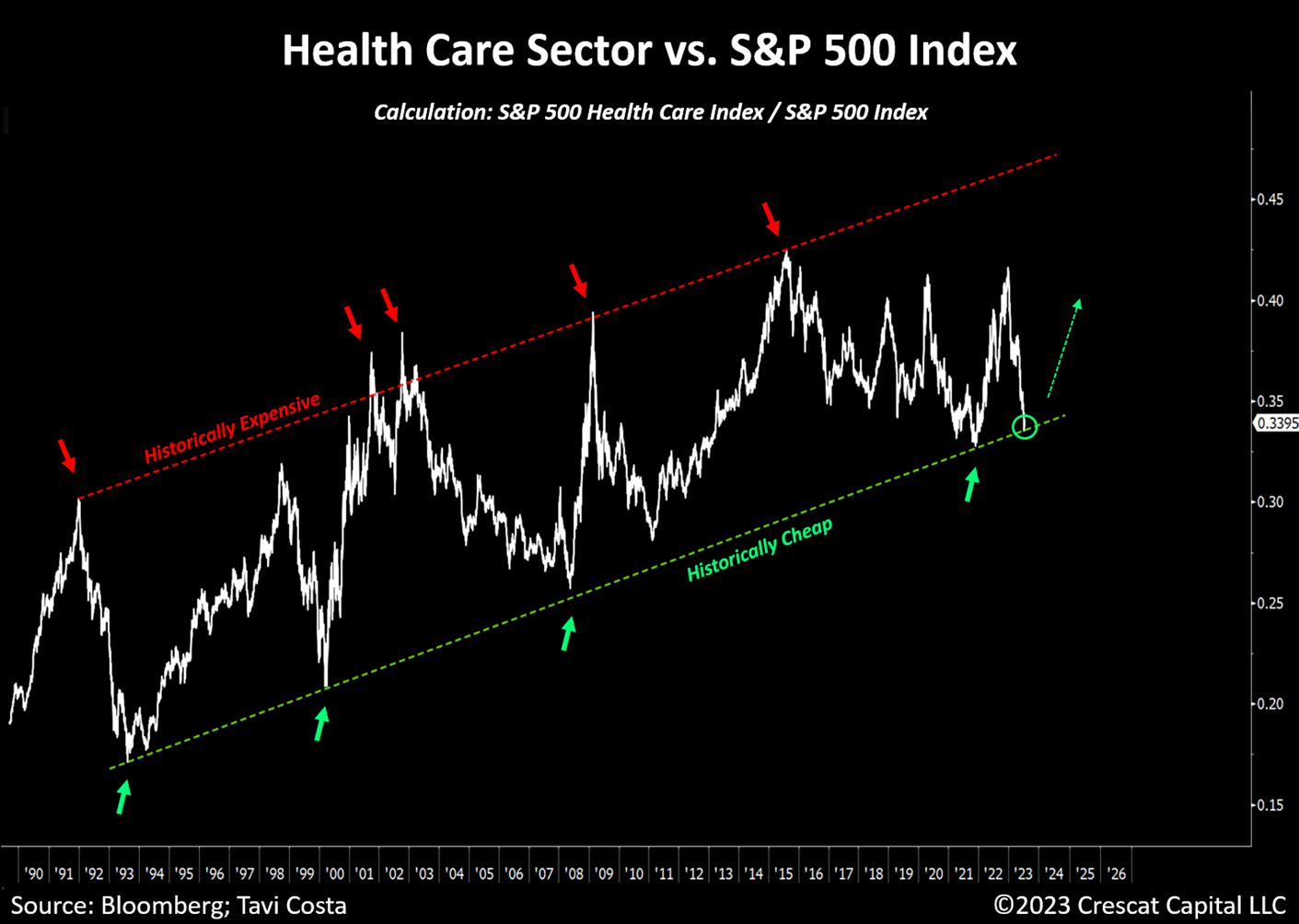

The healthcare sector is one area of the market outside of natural resource industries where we have become highly constructive on the long side given the recent price dislocation and valuation proposition, particularly biotechnology businesses. While the spotlight has been on historically expensive mega-cap technology companies fueled by AI developments, we believe strongly that healthcare stocks are poised to be among the primary beneficiaries of such technological advancements.

Over the past 30 years, the healthcare sector has demonstrated a consistent upward performance trend. Notably, these stocks tend to reach attractive valuations during market peaks and, more importantly, tend to outperform during economic crises.

The case for the Biotechnology industry is arguably even more compelling. Since 2015, these companies have drastically underperformed the S&P 500 and Nasdaq indices. The Nasdaq Biotechnology index, which includes larger and established businesses, currently has a price-to-sales multiple of approximately 5.5 times, down from nearly 13 times.

However, we find the development phase of the industry even more appealing. Several businesses on the cusp of breakthrough drug development are trading below their cash levels, with the potential to generate substantial cash flow over the next 3-5 years. To enhance our investment decision-making, we have recently hired Lars Thiel, Ph.D., as a research contractor. Dr. Theil seasoned scientist with over 30 years of experience in biomedical and drug discovery including 15 years with Amgen. Similar to our deep involvement in the mining and energy industries, we anticipate substantial growth in our exposure to the biotechnology industry in the coming years.

Brazil Liftoff

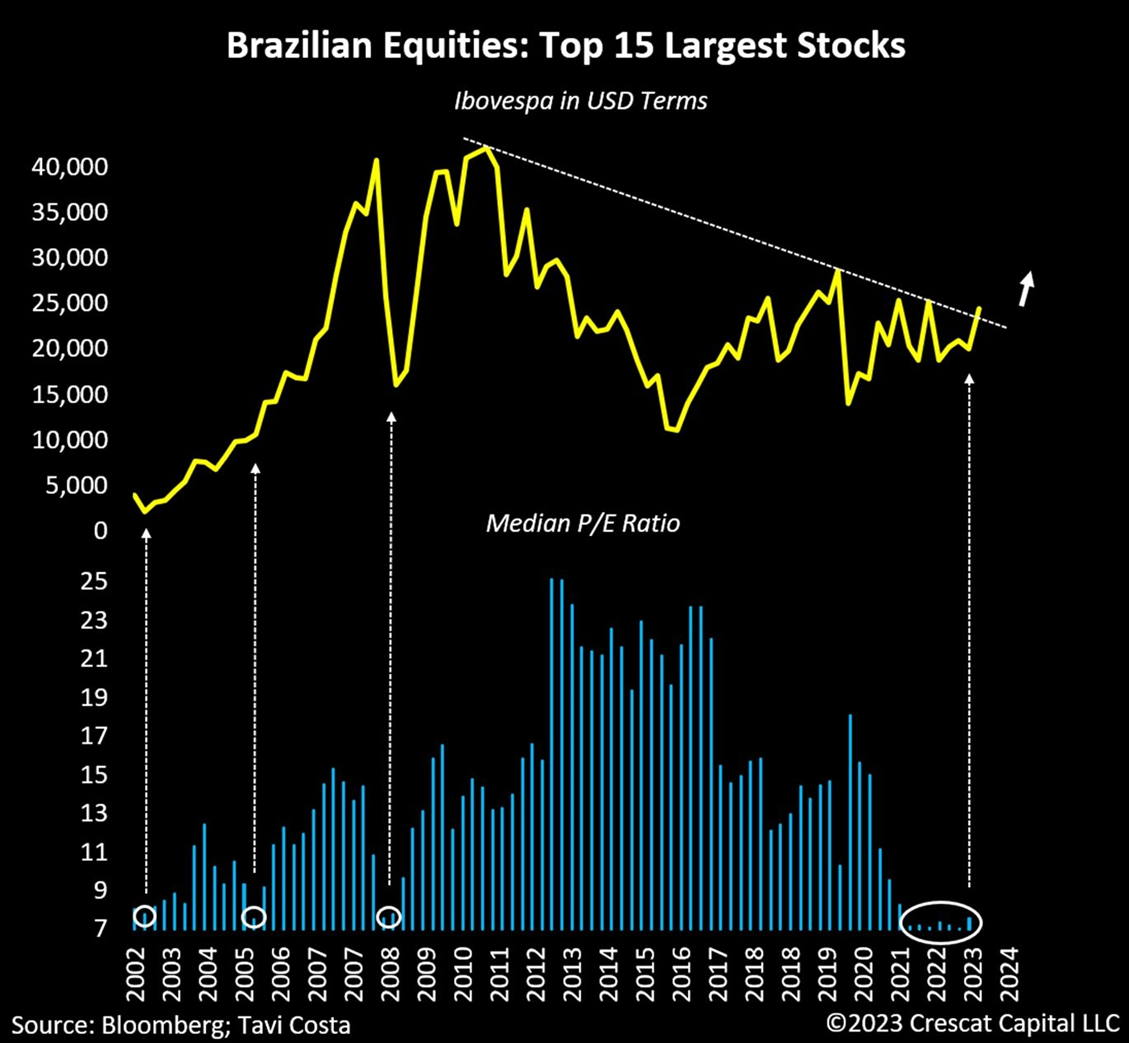

As an important way of capitalizing on a potential commodities-long thesis, we believe resource-rich economies are likely to perform exceptionally well. Rarely in history have Brazilian stocks been as cheap as they are today.

Given recent macroeconomic and political developments, it would be reasonable to assume that Brazil would have faced significant consequences. Firstly, the Fed implemented the steepest rate-hike cycle in history. Secondly, oil prices dropped by 45% from the recent peak. Additionally, the commodities equal-weighted index declined by 26%. And lastly, Lula assumed the presidency.

Interestingly and despite this sequence of facts, Brazilian stocks would have outperformed every developed market since 2022. In fact, Ibovespa continues to beat the S&P 500 year to date despite the AI euphoria. Today’s macro and fundamental reasons to own Brazilian equities are exceptional. In our view, this continues to be an incredible long-term buying opportunity.

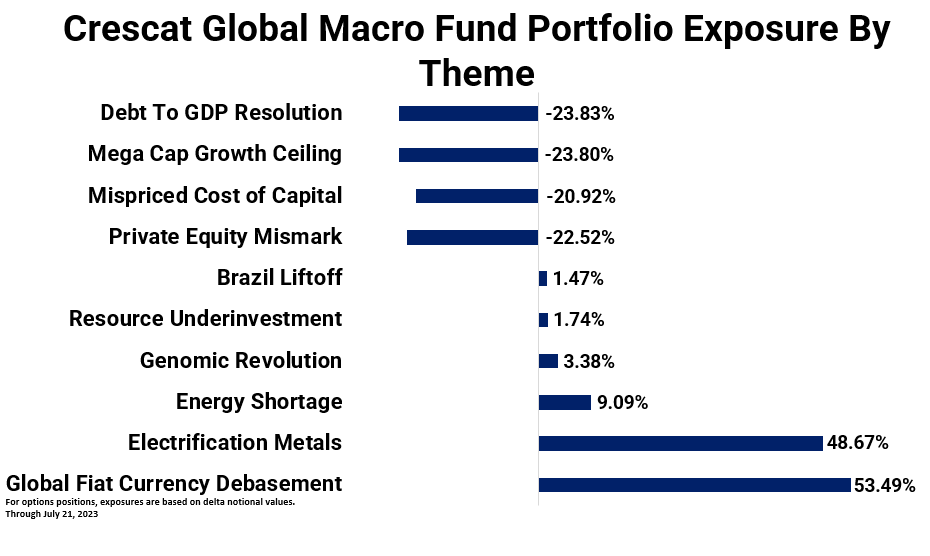

Crescat Macro Positioning Summary

At Crescat, we have three overriding, high-conviction macro themes supported by our independent research and proprietary models that we believe are poised to unfold in rapid succession over the short and medium term:

- We see highly overvalued long-duration financial assets as ripe for a major leg down due to the rising cost of capital and the deluge of US Treasury issuances now hitting the market. The Fed will ultimately need to accommodate the Federal debt but not before causing a financial asset meltdown and recession which we believe is its unspoken short-term objective. In our view, there is an abundance of timely and compelling short opportunities in the equity and fixed-income markets today.

- We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors. In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.

- From our perspective, we see a significant secular demand boom for commodities on the horizon fueled by fiscal stimulus from G7 economies. We believe the level of spending has the potential to rival and exceed China’s resource demand surge in the 2000s. In the US, three recently launched Congressional spending Acts stand ready to be expanded along with monetary policy support as soon as the recession becomes widely acknowledged to likely drive the entire next global economic expansion cycle.

Exposure By Themes July 21, 2023

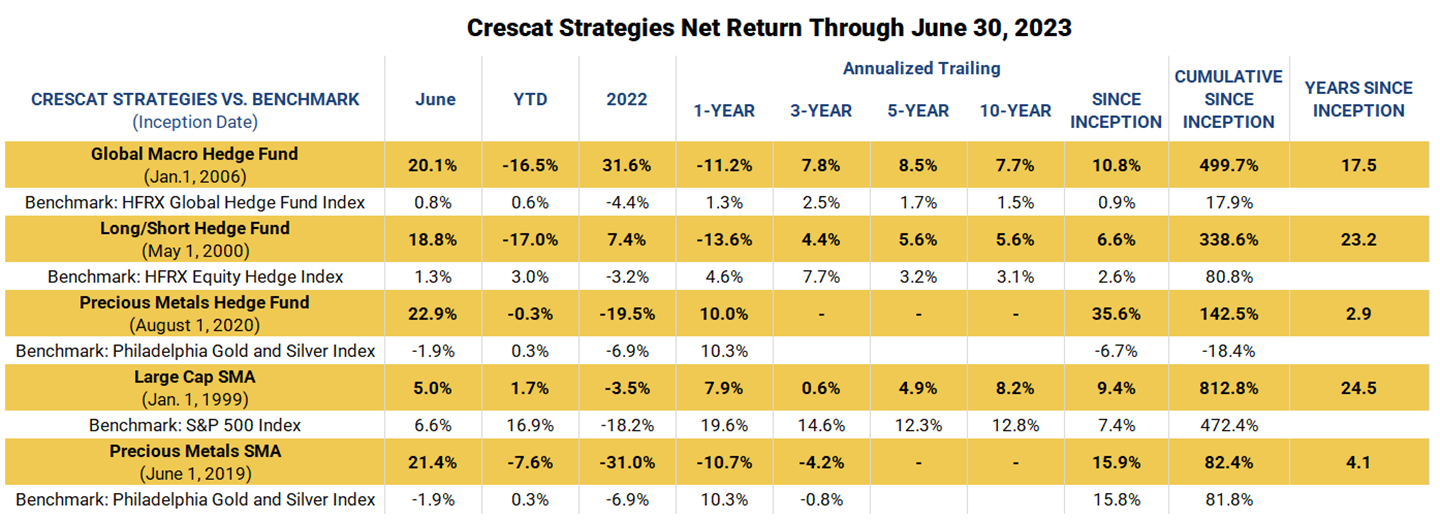

June Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Historical net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all fees and expenses (including a management fee and incentive allocation, where applicable). Individual performance may be lower or higher than the performance data presented. The performance of Crescat’s private funds may not be directly comparable to the performance of other private or registered funds. Investors may obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to info@crescat.net.

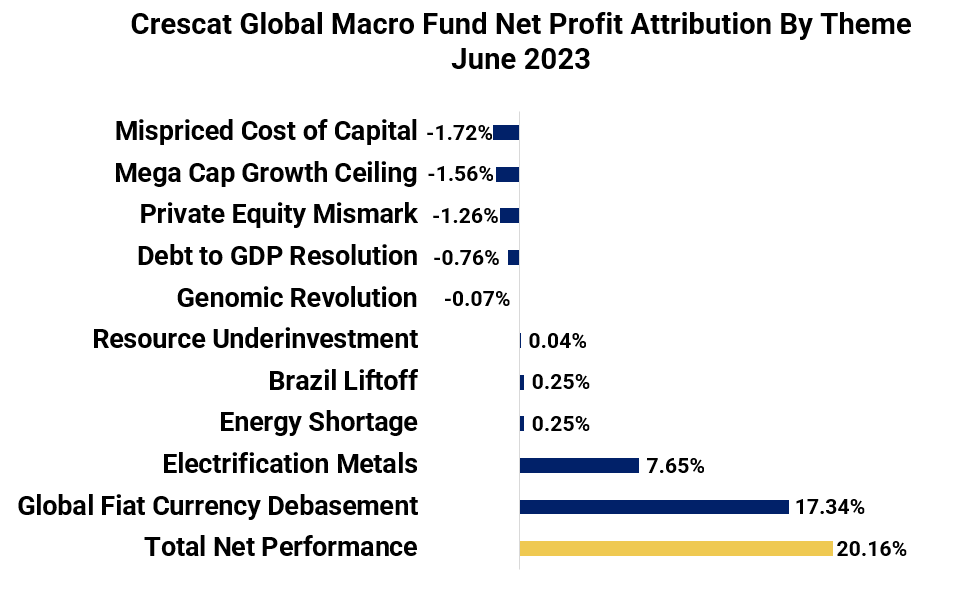

Profit Attribution, and Activist Metals’ Outlook

Crescat delivered outstanding firmwide net returns in June across our hedge fund and SMA strategies driven predominantly by broadly dispersed gains in our activist metals’ mining positions. Both precious and base metals remain a key long exposure to varying degrees across all Crescat strategies for the economic reasons outlined above.

Our metals exposure is predominantly focused on companies that control large new deposits, divided evenly between two thematic baskets: gold and electrification metals. The latter category includes silver, copper, nickel, lithium, and other valuable base and battery metals. Our exposure has been deliberately tilted toward the exploration segment of the mining industry today through a diversified global portfolio given the extraordinary macro setup.

Over the past three years, under the guidance of renowned exploration geologist Quinton Hennigh, Ph.D., a partner at Crescat Capital, and a senior member of our investment team, we’ve built a portfolio of activist-sized stakes in over 50 mining companies which are spread to varying relative exposures across four of our five investment products. Our portfolio companies have substantially outpaced the world’s largest miners in greenfield exploration drills worldwide over the last three years.

Thanks to Crescat’s early-stage investments and Quinton’s technical assistance, many of our portfolio companies have already made bona fide and promising world-class discoveries of large new metal deposits in viable mining jurisdictions, positioning them ahead of an anticipated M&A cycle.

A decade-plus of underinvestment in exploration and new mine development by the majors has created a production cliff, while secular inflationary forces are driving increased investor appetite for gold and silver. Simultaneously, the green energy transition and its corresponding electrification wave are boosting industrial demand for metals. Our research indicates a substantial increase in metal requirements over the next several years that should propel commodity prices higher in the face of a structural supply gap. We believe this gap can only ultimately be filled with major new high-grade discoveries like those in our portfolio.

Given the significant time required to turn new metal discoveries into mine production, we expect upward price shocks in the metals markets along with general inflationary pressures that are poised to remain substantial over at least the next three years. Consequently, we anticipate that larger mining companies will need to acquire new deposits like those of our portfolio companies at significant premiums to their current valuations in a race to increase production to meet the growing global demand.

Our firmwide activist metals portfolio forms a significant component of all Crescat strategies today, offering investors access to this critical yet highly undervalued segment of the mining industry. We believe our metals portfolio presents substantial appreciation potential, not only in the near term, where our models foresee a stagflationary hard landing, but also throughout the entire next macroeconomic growth cycle. As a key growth driver for that cycle in the US, the CHIPS and Science Act, Bipartisan Infrastructure Law, and Inflation Reduction Act are major fiscal spending programs that have the potential to be expanded significantly to improve the nation’s global economic competitiveness while reducing reliance on China.

We believe our funds provide an opportunity for institutional and high-net-worth investors seeking to capitalize on the compelling prospects of our activist metals approach over this entire cycle.

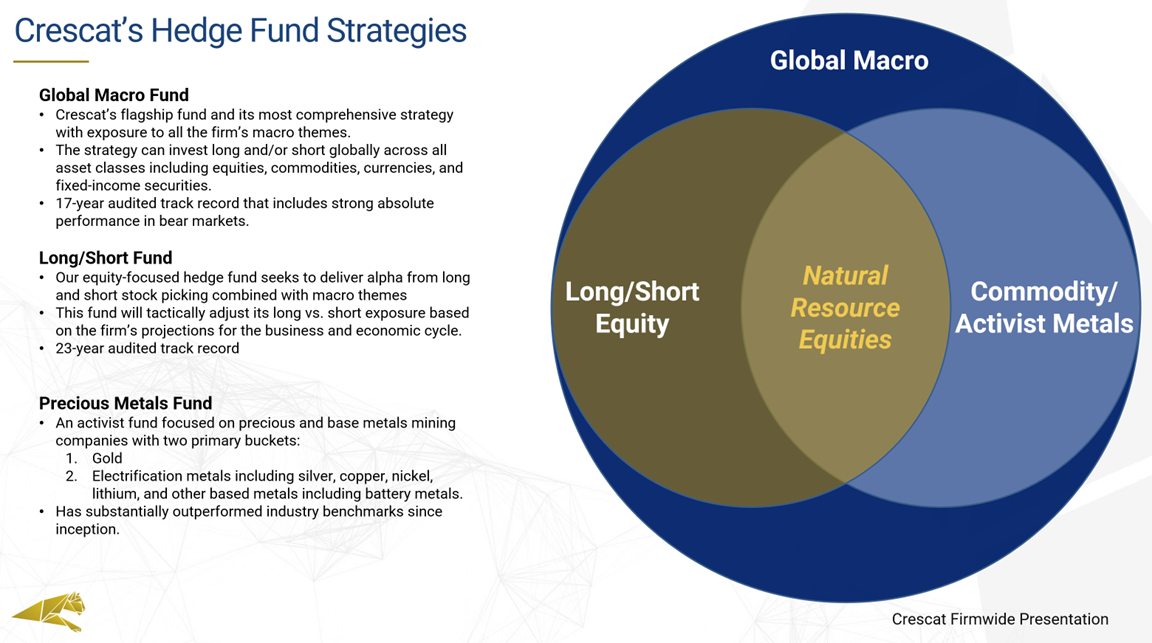

Differentiation and Overlap Across Crescat’s Hedge Funds

We are very excited about the investment opportunities in the market today on both the long and short sides of the market and strongly encourage you to reach out to us if you are interested in learning more.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

For more information including how to invest, please contact:

Marek Iwahashi

Investor Relations Coordinator

303-271-9997

Linda Carleu Smith, CPA

Member & COO

(303) 228-7371

© 2023 Crescat Capital LLC

Important Disclosures

Performance data represents past performance, and past performance does not guarantee future results. An individual investor’s results may vary due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars. Cash returns are included in the total account and are not detailed separately. Investment results shown are for taxable and tax-exempt clients and include the reinvestment of dividends, interest, capital gains, and other earnings. Any possible tax liabilities incurred by the taxable accounts have not been reflected in the net performance. Performance is compared to an index, however, the volatility of an index varies greatly and investments cannot be made directly in an index. Market conditions vary from year to year and can result in a decline in market value due to material market or economic conditions. There should be no expectation that any strategy will be profitable or provide a specified return. Case studies are included for informational purposes only and are provided as a general overview of our general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of our strategies or of the entirety of our investments, and we reserve the right to use or modify some or all of the methodologies mentioned herein.

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of a fund managed by Crescat may be offered to selected qualified investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund and which supersedes information herein in its entirety. Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, and should be made after reviewing such Offering Documents, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities 12 often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

RUSSELL 1000 INDEX. The Russell 1000 Index is a market-cap weighted index of the 1,000 largest companies in US equity markets. It represents a broad scope of companies across all sectors of the economy. It is a commonly followed index among institutions. This index contains many of the same securities as the S&P 500 but is broader and includes some mid-cap companies. It is a suitable benchmark for the Crescat Large Cap SMA strategy, which has predominantly held and traded similar securities since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in Crescat’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a Crescat hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. Crescat’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to Crescat’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any Crescat hedge fund with the SEC. Limited partner interests in the Crescat hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in Crescat’s hedge funds are not subject to the protections of the Investment Company Act of 1940. Performance data is subject to revision following each monthly reconciliation and annual audit. Current performance may be lower or higher than the performance data presented. The performance of Crescat’s hedge funds may not be directly comparable to the performance of other private or registered funds. Hedge funds may involve complex tax strategies and there may be delays in distribution tax information to investors.

Investors may obtain the most current performance data, private offering memoranda for Crescat’s hedge funds, and information on Crescat’s SMA strategies, including Form ADV Part II, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each Crescat hedge fund for complete information and risk factors.