There are three supporting themes driving our conviction that the timing for investing in gold, silver, copper, and other metal exploration stocks has never been more compelling:

- In our analysis, the unsustainable debt and government deficits in developed economies make inflationary pressures intractable and fiat currencies more susceptible to debasement than they have been since the 1970s.

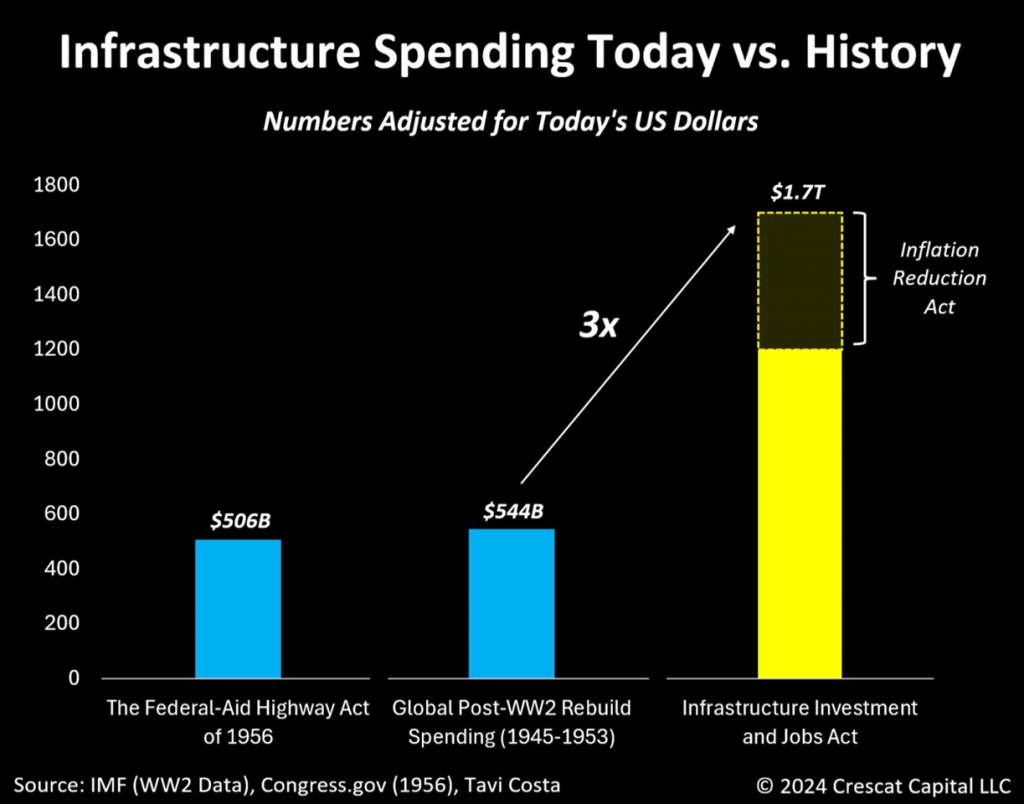

- We believe there are critical metal supply constraints under rising demand given US government spending initiatives going toward commodity-hungry infrastructure, reshoring of manufacturing supply chains, and green energy projects.

- There is an opportunity to generate significant alpha and beta to outperform metal prices in their likely coming bull market through our activist exploration portfolio where our companies seek to make economic discoveries and build resources through carefully constructed drill programs in viable mining jurisdictions around the world.

Metals exploration investing is risky, however. There are 3,596 publicly traded mining and metals stocks globally, more stocks to choose from than any other industry. The vast majority of these are junior explorers, i.e., small and microcap companies that own mining claims with hopes and dreams of big discoveries. Most of them will never get much further than that. Therefore, we believe this is an industry where investors can benefit from professionally managed stock selection.

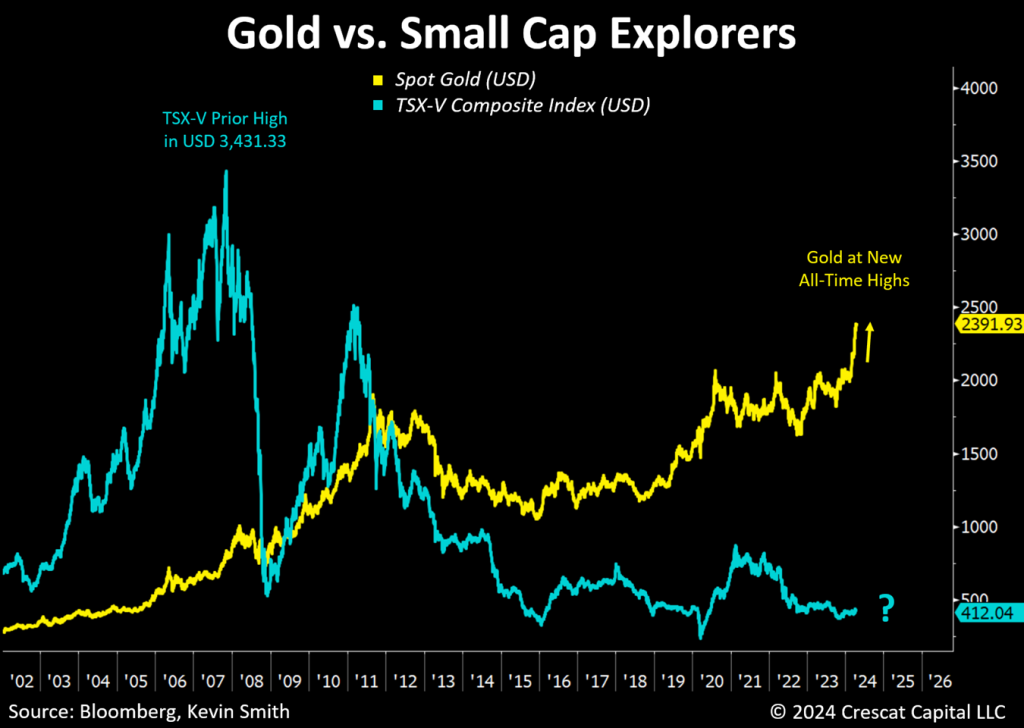

With gold having broken out to new all-time highs recently, mining exploration companies have strong upside potential, in our view, as they have lagged significantly and should soon begin to catch up.

Why are the TSX Venture Composite Index and the TSX-V Exchange in Canada relevant proxies for exploration-focused mining stocks? The TSX Venture Composite Index is one of the longest-running indices with a heavy concentration of mining exploration stocks. As of 4/19/24, there were 127 companies in the TSX Venture Composite Index. Their average market cap was USD 270 million. 85 of these companies or 67% of them are in the mining & metals industry and had an average market cap of USD 183 million. The index is a subset of the broader TSX Venture Composite Exchange which has a total of 1,891 companies listed on it with an average market cap of USD 35 million. To be included in the TSX-V Composite Index, a security must have a relative weight of at least 0.20% of the total capitalization of the TSX-V Exchange. 967 of the companies on the overall TSX-V Exchange or 51% of them are in the mining and metals industry with an average market cap of USD 29M. The mining companies listed on the TSX-V Exchange are almost all exploration-focused miners, a large universe of publicly traded companies for Crescat to consider for its exploration-focused activist metals and mining investment theme. TSX-V mining companies tend to be explorers because once these firms become more advanced and go into development or production, if not bought out by a larger firm first, they will typically move their listing up to the TSX big board.

Crescat’s Activist Approach

To turn mining claims into economic metal discoveries that will go on to become profitable mines is one of the toughest businesses in the world. We believe the potential rewards make it well worth the challenge.

For the average investor, sifting through all these companies to find which ones to invest in would be a near-impossible challenge with very low odds of a successful outcome. At Crescat, we vet a multitude of exploration opportunities continuously with the help of our partner and in-house geologic and technical director, Quinton T. Hennigh, PhD. Fortunately, he can quickly disqualify most of these potential investments based on his forty years of mining industry experience which includes working for major gold mining companies including Homestake, Newcrest, and Newmont.

When Crescat chooses to invest in an explorer, we take a hands-on activist role to maximize the odds of a successful outcome while minimizing the risk. Other the last four years, we have built an activist portfolio that currently consists of 78 exploration-focused companies. Crescat’s funds collectively own substantial equity stakes in these companies, 12% at the median across them all on a partially diluted basis which includes warrants.

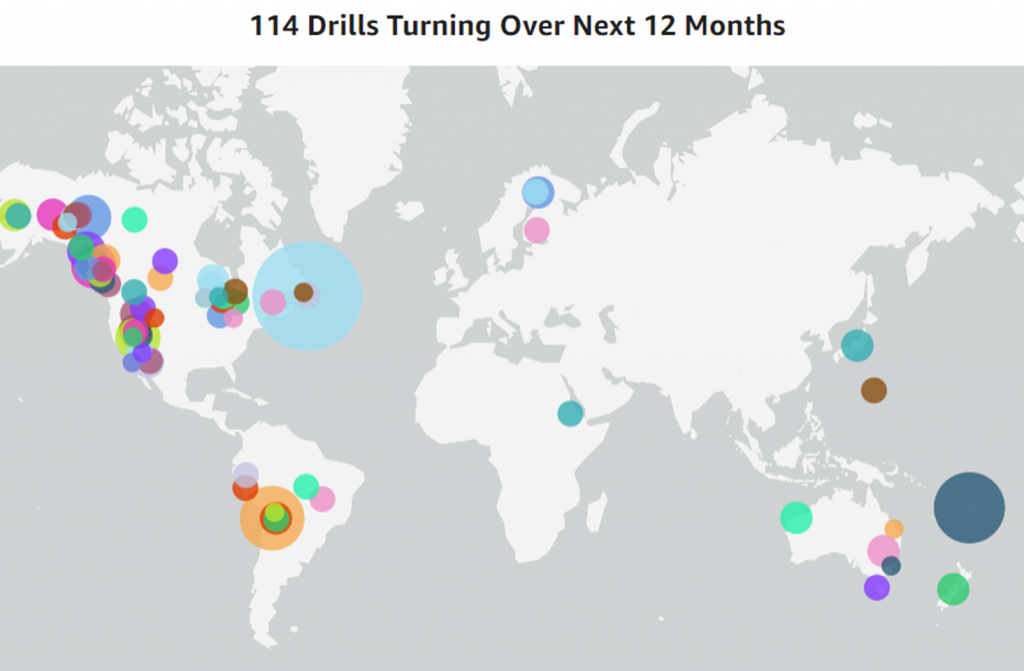

To date, 59% of the 78 companies in our portfolio have made bona fide discoveries based on their drilling progress to date using our primary criteria of at least three 100+ grams per ton times meter length intercepts of gold-equivalent mineralization. Among our current portfolio, we expect to have 114 drills operating over the next year around the world, which we believe will be more greenfield drilling than the top three public precious metals miners, Newmont, Barrick, and Agnico Eagle combined.

Making an economic discovery requires hard work, staking and negotiating claims, fieldwork applying geology, geochemistry, and geophysics, addressing key environmental, government, and social licensing issues, building strong relations with local communities and indigenous nations, securing drill permits, raising capital, working with drillers, logging core, assaying, metallurgical analysis, hiring the best resource modeler, among many other things, all in face of constant obstacles and adversities from multiple angles.

Being able to communicate well while engaging with investors, brokers, investment bankers, securities regulations, and lawyers is critical throughout the process along with good budgeting, hiring, and management skills.

Strong education and experience of the management and technical team are important but not the only criteria we require. We seek to fund mining exploration teams run by intelligent, creative, independent thinkers with inherent confidence and self-motivation who are strong communicators, trustworthy, hard-working, and persevering. We welcome all dedicated and qualified management and technical teams to pitch us your story.

Supply Underinvestment Combined with a Demand Boom

What do you get when you mix a decade or more of underinvestment in mining with a booming new demand for metal resources? In our view, it’s a formula for skyrocketing metal prices. Gold, silver, and copper deposits are worthy of investment given this macro landscape today. But, unfortunately, most investors are still too busy chasing tech stocks, junk bonds, and cryptocurrencies while also getting stuffed with an endless supply of Treasury securities needed to fund the most ambitious US government Keynesian spending programs in our country’s history relative to GDP.

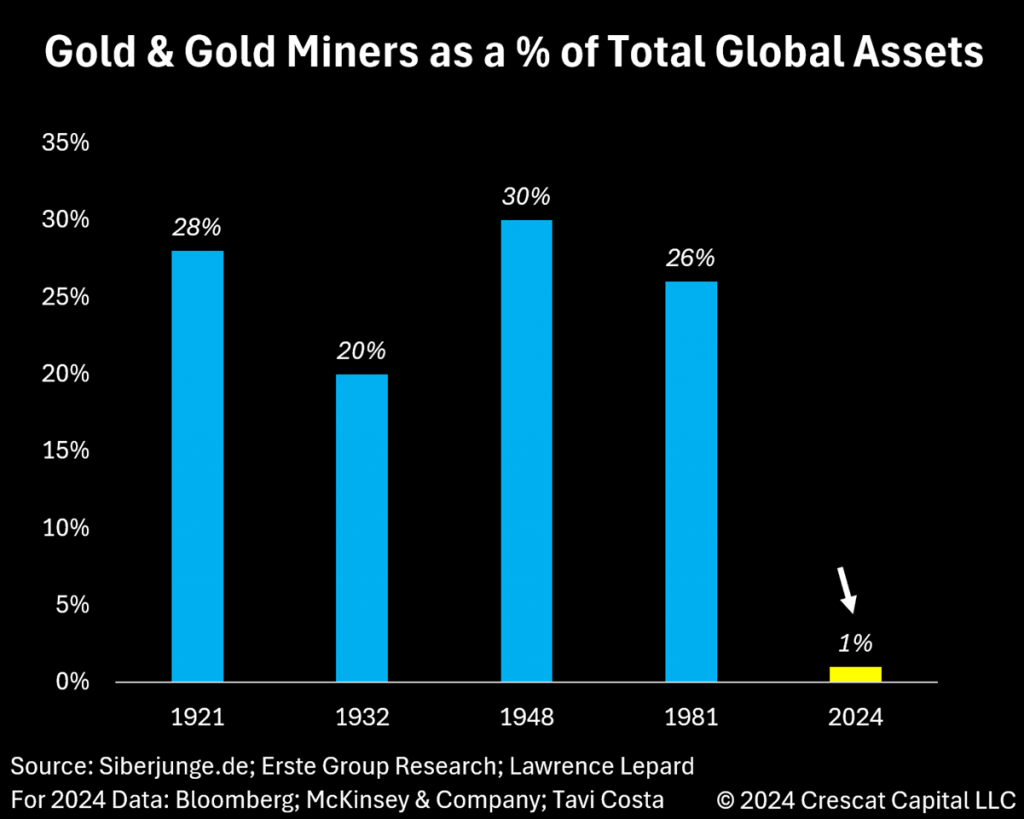

A Historically Undervalued Asset Class

For us, mining exploration presents an incredibly exciting and uncrowded investment opportunity, one with substantial asymmetric upside. The multitude of structural forces driving metals has yet, in our opinion, to prompt a major re-rating of the valuations of mining firms, which continue to linger at historically depressed levels.

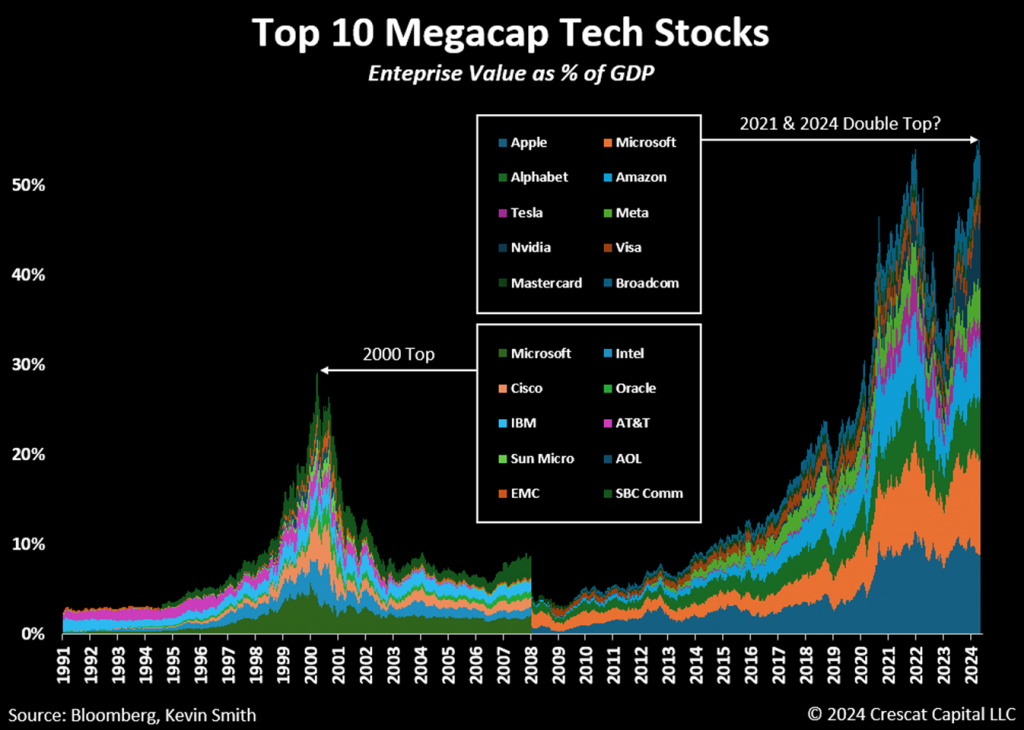

Tech Bubble 2.0

We have long believed that government fiat money printing in the wake of the GFC in the face of ongoing government debt and deficits would lead to substantial inflation. But instead of creating traditional inflation right away, the money printing has led to inflation in financial assets, including mega-cap tech stocks, to a degree that we never believed possible after the lessons from the 2000 tech bubble and ensuing bust. We believe the current tech bubble, punctuated by an unsustainable AI investing and spending frenzy, has finally reached full maturity and is ripe for a bust.

Disclosure: Crescat may or may not hold positions at any given time in the securities referenced herein. This is not a recommendation or endorsement to buy or sell any security or other financial instrument.

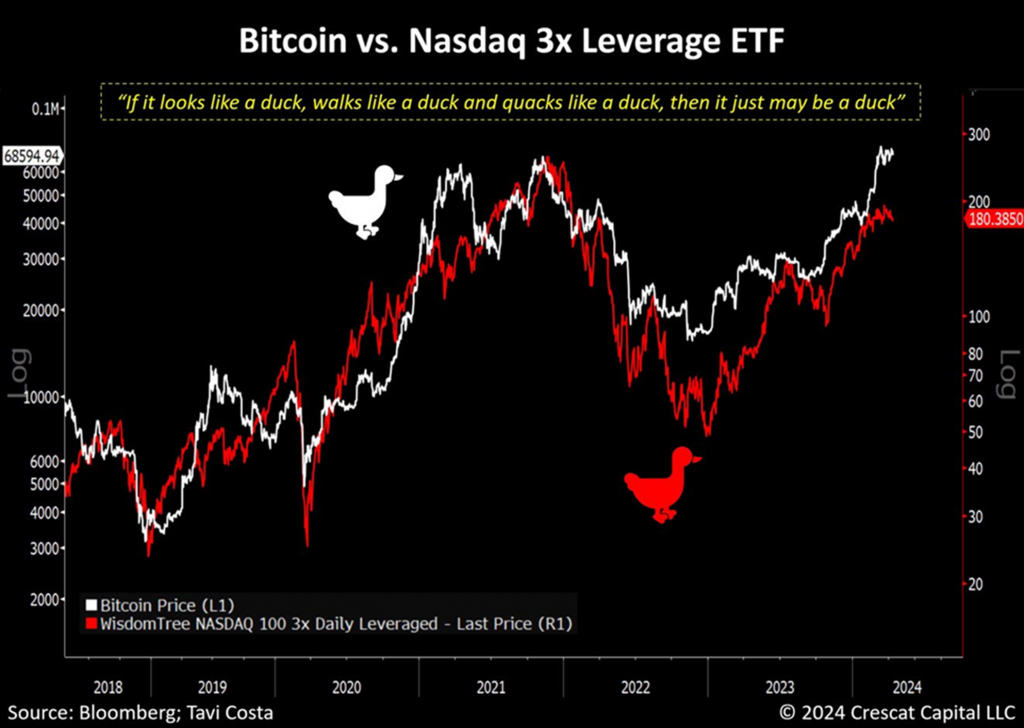

The historic levels of money printing in the US since the GFC have also led to pure speculation in abundant issuances of cryptocurrencies that, in our opinion, are assets with no intrinsic value at all, despite the energy and money expended on them. Gold, on the other hand, is prized as money and as an inflation-hedge asset by governments, central banks, and citizens alike, precisely because of its intrinsic value that has endured for millennia. It also has industrial demand and is used in electronics, even Nvidia GPUs, and as a catalyst in chemistry applications, not to mention its consumer value as jewelry. Let’s not fool ourselves though, it’s the monetary demand for gold that dominates.

Crypto, A Byproduct of Excessive Liquidity

Cryptocurrencies, meanwhile, in our opinion, are not a scarce hard asset or inflation hedge at all but trade solely on a “greater fool” theory, yet another unintended and purely speculative outcrop of government debt creation, deficit spending, and excessive fiat money printing. Charlie Munger called them “crypto crap”. We agree with that sentiment. Bitcoin, the leading crypto, does not trade like gold at all by the way, as some of its proponents fantasize. It trades like the Nasdaq 100 with 3x leverage.

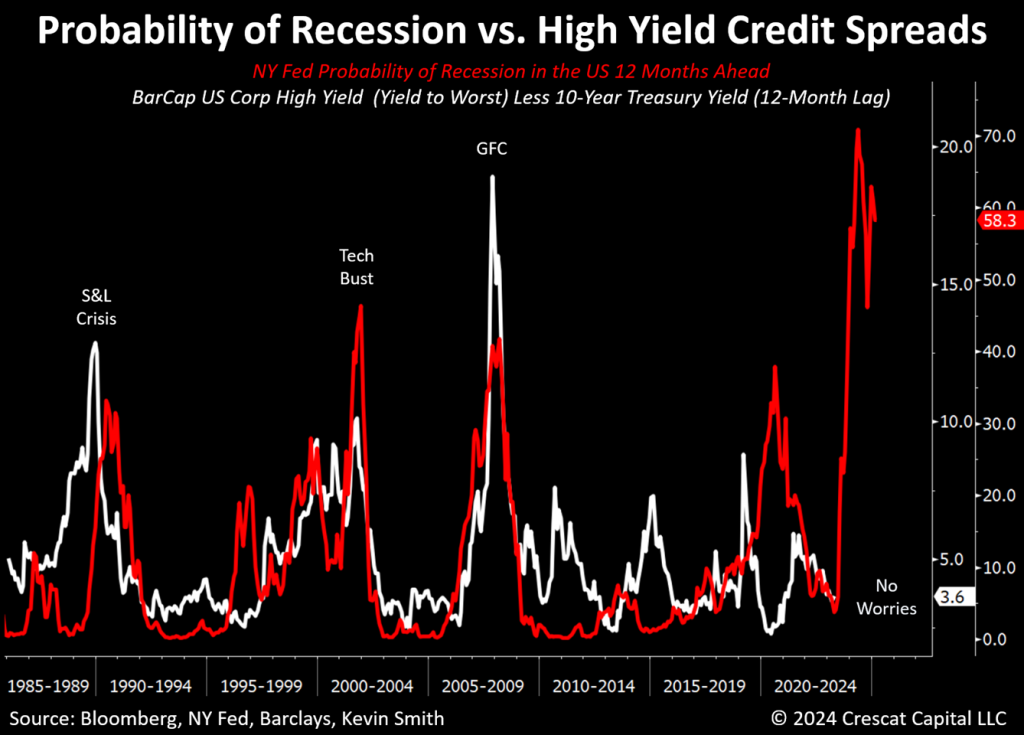

Yield Curve Leads Junk Bonds

Speculation in junk bonds has also been rampant where it seems investors are completely oblivious to the historical timing lesson of the inverted yield curve as it relates to the lagging risk to high-yield credit spreads and high risk of impending recession. The mantra is that because of the AI revolution, it’s different this time, but that is always the mantra at times like this. Sure, it might be different this time, i.e., no recession and no blowout in credit spreads, but we don’t believe that for a minute. The true lessons from technological disruption and its short-term threats to the economy we think will need to be learned all over again.

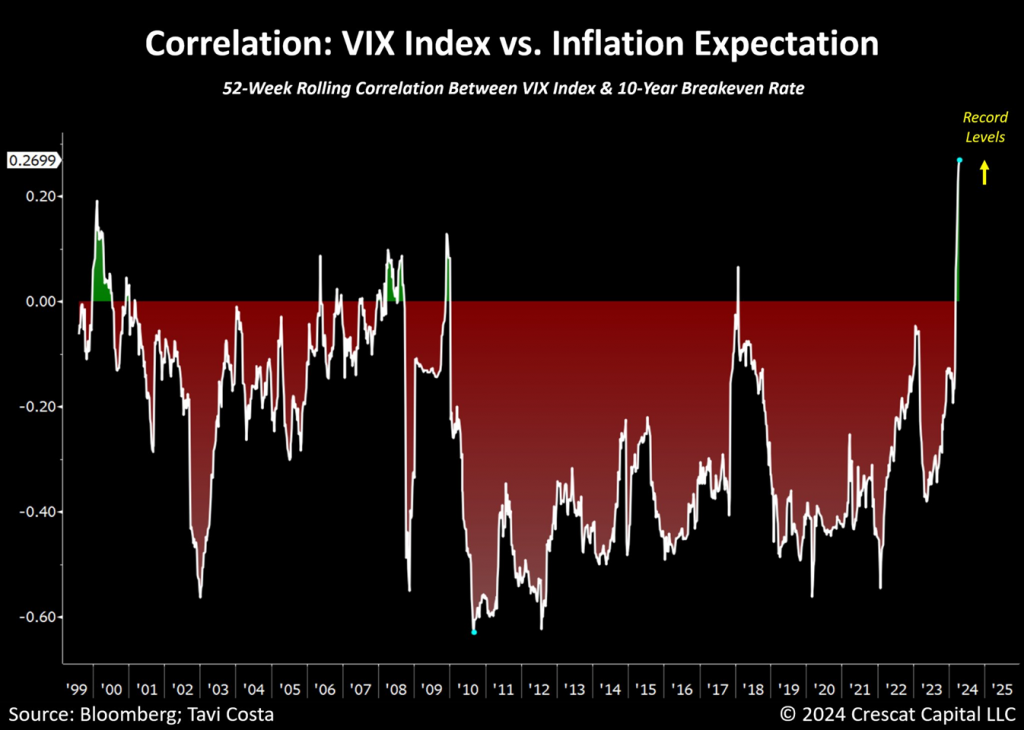

Signs of Stagflation

Equity market volatility and inflation expectations are the most significant positive correlation we’ve seen in decades. In our view, this is a major stagflationary warning signal.

Although the data is not available to extend the chart below further back, a similar phenomenon occurred in 1973-1974 as the broad stock market faced difficulties whenever inflation reaccelerated at the same time as commodities and commodity equities surged higher.

This is especially pertinent now, with energy prices, agricultural commodities, precious metals, copper, global freight costs, and other inflation indicators showing significant resurgence.

A Brief Economic History of the World

Gold is indeed perceived as uncool to most modern-day hipster tech investors and crypto traders. Fortunately for us, we believe humans have a natural affinity for the metal which is in our DNA dating back to the earliest historical evidence of our existence. Archaeologists have found gold flakes in Paleolithic caves that date back 40,000 years. Precious metals have had a rich and enduring world economic history on their side.

In Ancient Egypt from 3100 to 332 B.C.E, silver along with agricultural goods were used as money. Gold was the sacred skin and flesh of the gods. Pharaohs who were considered divine beings wore it and were buried with it.

The gold mask of Tutankhamun on display in the Egyptian Museum, Cairo.

Imperial Rome from 46 BC to AD 476 was one of the biggest and most enduring world economic powers of all time. Rome wasn’t built in a day. It was financed and built over five centuries with gold and silver coins, which the empire used to conduct trade and pay its armies.

China Invents Paper Money, A Huge Success Initially

Fiat paper money was first invented in China during the Song dynasty (960-1279 AD). The Chinese invented movable-type printing centuries before the Guttenberg printing press. The Chinese would also invent gunpowder for weapons, the magnetic compass, the mechanical clock, and the pound lock, a type of canal lock during this period. The primary reason for inventing movable-type printing, of course, was to print money. The Song banknotes were exchangeable for metal coins. Paper money backed by metal was a remarkable success in helping this dynasty to be one of China’s most technologically advanced and economically prosperous of all time. Movable-type printing also facilitated rich cultural advancement for the Chinese during this time through the dissemination of literature, drama, fiction, and poetry.

A Venetian merchant and explorer would travel extensively in China during the late 13th century. His book, “The Travels of Marco Polo”, written around 1300, described his astonishment at witnessing the use of paper currency throughout the Yuan dynasty under Kublai Khan. This Mongol dynasty had overthrown the Song but would go on to suffer from hyperinflation after issuing excessive amounts of paper currency to fund its wars and expansionism while depleting their silver.

Conquistadors Look for Gold, Find a Mountain of Silver

In the early 1500s, Spanish conquistadors went looking for gold in Central and South America. What they found, in addition to some gold, was a mountain of silver. Spanish mines in the Americas produced over 150,000 tons of silver, between the 16th and 18th centuries, over 80% of the world’s supply making Spain the wealthiest and most powerful nation in the world by the late 1500s. The discovery of just one giant orebody alone, Cerro Rico de Potosí, in modern-day Bolivia, would account for over 37% of the world’s silver production from 1545 to 1810.

At the same time as Spain ruled the world through its colonialism in the 16th century, the Ming dynasty in China from 1368-1644 would rival it in economic power driven by thriving global trade, an influx of silver from Japan and the Spanish Americas, reduced taxes, and capitalism. Silver was in high demand in China during the Ming period as it became the standard currency, replacing paper money. Taxes were required to be paid in silver starting in 1465. The widespread use of silver as currency fueled its economic growth. China had a massive trade surplus with Europe, exporting high-value goods like porcelain, silk, and tea in exchange for its silver.

The American Gold Rush

In 1848, James W. Marshall, overseeing the construction of a sawmill at Sutter’s Mill in the territory of California, struck gold. Arriving in covered wagons, clipper ships, and on horseback, some 300,000 migrants known as “forty-niners” began to arrive in California a year later. The Gold Rush fueled rapid economic growth and prosperity in California and would provide the capital to fund the Industrial Revolution in the US.

The Adventures of Samuel Clemens

Samuel Langhorne Clemens from Missouri just wanted to be a steamboat pilot on the Mississippi River which he achieved at age 23 in 1859. Then the Civil War broke out in 1861. He would “light out of there” as his character Huck Finn would say. He escaped conscription into the war from both sides and fled West to get a mining job in the boomtown of Virginia City, Nevada where the Comstock Lode had been discovered in 1859. He noticed that the men who were mining for gold and silver were all doing extremely hard work and were not making any money. At the same time, the mine owners who were trading paper were getting rich. So, he quit his job and invested his hard-earned savings in a few gold and silver mining stocks. It didn’t take long for him to realize that they were all worthless.

Many of the Comstock-related companies trading on San Francisco stock exchanges were total scams, insider trading frauds based on bogus discovery stories. Mark Twain’s famous quip that “a gold mine is a hole in the ground with a liar standing on top of it” comes from this experience. Twain’s life experiences made him one of America’s greatest authors and humorists, but he was a notoriously bad investor.

He invested millions in today’s dollars into the development of the Paige Compositor between 1880 and 1894. However, the invention was rendered obsolete the following year by a competing technology. This failed investment, along with Twain’s other speculative ventures into new technologies of the time, such as a steam generator, engraving process, magnetic telegraph, and steam pulley, caused him to lose the majority of his fortune which included his wife’s estate. Twain’s financial misfortunes were exacerbated by his lavish spending on things like a 25-room mansion in Hartford, entertaining frequently, and trips to Europe. He went bankrupt in 1894.

Newmont Mining Brings Legitimacy to Mining Stocks

William Boyce Thompson, born in 1869 and raised in Butte, Montana, was a much better investor than Mark Twain. Butte was home to the Anaconda Copper Mine, the largest copper mine in the US by 1892 and one the largest in the world at its peak in the early 20th century. Thompson grew up fast in this rough-and-tumble mining town and excelled at a young age as a poker player. His high school English teacher realized that he had an unusually keen intelligence and convinced his parents to send him back East where he was educated at Exeter and Columbia.

Thompson founded his trading company, Newmont, which was short for New York and Montana Company in 1921 and listed it on the New York Curb Exchange which would later become the American Stock Exchange in 1925. The company’s name would later be changed to Newmont Mining.

Like the Comstock insiders, Thompson was a gifted stock trader and promoter, but he was not a scammer. He saw the value in building successful mining operations. He did this by hiring the very best prospectors, geologists, engineers, accountants, and legal advisors and built a tremendously profitable copper mining conglomerate during his lifetime. He died a rich man at age 61 in 1930, worth about $2 billion in today’s dollars though this was off his peak on account of the Depression. His foundational principles of hiring the absolute best business and technical people to run his trading company’s underlying business operations would continue after him as would his company.

Thompson’s story and that of Newmont Mining was written and told in 1972 in the book Men and Mines of Newmont, A Fifty-Year History, by Robert H. Ramsey. At that time, Newmont had been publicly traded since 1925. The book is now out of print but is one of the greatest books on mining investing ever. It is revered like the bible at Crescat.

As told by the author, “If one had bought 100 shares of Newmont at $40.00 when it went public in 1925, and neither bought nor sold thereafter, he would now own, through stock splits and dividends, 4,330 shares, worth, as of February 1972, about $140,000, which would yield $4,503.20 per year in dividends.” In other words, Newmont returned 3,400% over this period.

Bre-X

The Bre-X mining scandal was one of the biggest corporate frauds in Canadian history and made the Comstock mining schemes look like child’s play. In 1993, a Filipino prospector named Michael de Guzman claimed to have discovered a massive gold deposit in the Busang region of Indonesia while working for the small Canadian mining company Bre-X.

Over the next few years, Bre-X’s share price skyrocketed as the estimated size of the gold deposit grew to over 200 million ounces, making it the “richest gold deposit in the world”. However, the gold samples that de Guzman provided were later found to be “salted” or artificially enriched with gold. It was the same trick the Comstock insiders had employed.

When Freeport McMoran was brought in to help extract the gold, they soon discovered that the entire Busang project was a fraud. In March 1997, de Guzman died in a suspicious helicopter “accident”, though some speculate he may have faked his death.

Bre-X’s stock price collapsed, costing investors billions of dollars. Investigations revealed that de Guzman had simply filed gold off his wedding ring to spike the samples and dupe the testing labs.

The Bre-X scandal highlighted major weaknesses in Canada’s financial regulations and disclosure requirements at the time. It led to reforms to better protect investors from such fraudulent schemes in the future.

Investor Protection in Mining Securities

In the wake of Bre-X, the Canadian Securities Administrators (CSA) instituted National Instrument 43-101 (NI 43-101), which has become a global standard for the reporting of mineral exploration, development, and production activities and made Canada the leading global destination for incorporation and public listing of mining companies.

Here’s how NI 43-101 has provided enhanced protection for investors compared to before it was enacted:

Qualified Person (QP) Requirement

NI 43-101 requires that all technical information disclosed to the public be prepared or supervised by a “Qualified Person.” A QP must have the relevant education, experience, and professional standing to ensure that the information is reliable and accurate. This requirement aims to prevent misleading or incorrect technical information from being disclosed to investors.

Consistency and Standardization

Before NI 43-101, there was a lack of consistency and standardization in reporting mineral resources and reserves. NI 43-101 established uniform definitions and formats for reporting, ensuring that investors can compare information across different companies and projects with greater confidence.

Independent Technical Reports

NI 43-101 requires companies to file detailed technical reports, known as NI 43-101 reports, at various stages of a mining project. These reports are reviewed and signed off by a Qualified Person. By mandating these independent reports, the standard aims to provide investors with reliable and objective information, reducing the risk of misleading or fraudulent disclosures.

Disclosure Requirements

The standard requires mining companies to provide thorough and transparent disclosures regarding mineral resources, reserves, exploration activities, and production. This comprehensive disclosure allows investors to make more informed decisions based on a clear understanding of the company’s assets and activities.

Continuous Reporting and Material Changes

Companies are required to continuously report significant changes in their mineral projects. If a material change occurs, such as an increase or decrease in resources, or a change in project economics, the company must file an updated NI 43-101 report. This requirement ensures that investors are kept informed of major developments that could impact their investment.

Protection Against Misleading Information

Prior to NI 43-101, some mining companies engaged in promotional or misleading disclosures to attract investors. The standard prohibits such practices by requiring accurate and fact-based reporting. Violations of NI 43-101 can result in sanctions and penalties, further protecting investors from potential fraud.

There are still many ways for investors to lose money in mining stocks, but it is an industry that we are very excited to be investing in today because of where we likely are in the gold cycle. We believe our activist equity exploration portfolio approach is a great way to create wealth and profit from our macro thesis for our investors as we are striving to maximize our chances of being part of creating many large new economic discoveries from an early stage to more than compensate for the inevitable risks of investing in other mining stocks that disappoint.

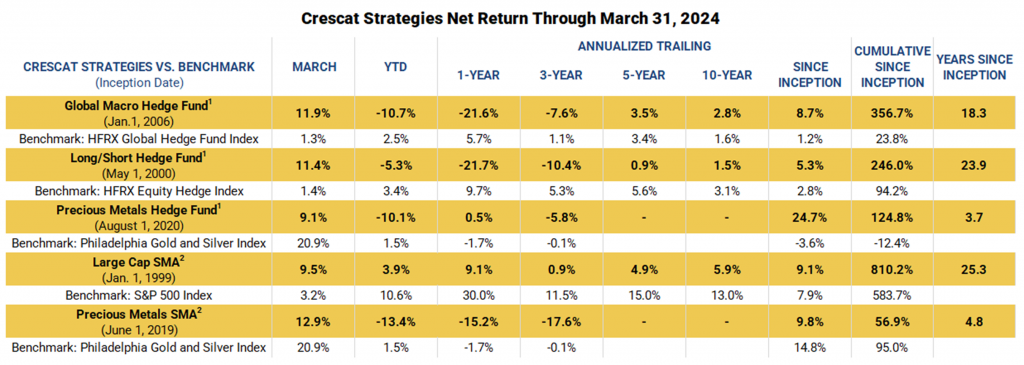

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm. See additional performance disclosures below.

We encourage you to reach out to any of us listed below if you would like to learn more about how our vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Director

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

(303) 228-7371

© 2024 Crescat Capital LLC

Important Disclosures

The purpose of this letter is to provide access to analyses prepared by Crescat Portfolio Management LLC (“CPM”) with respect to certain companies (“Issuers”) in which CPM and certain of the Funds and accounts it manages are shareholders. The letters enable CPM to share macro themes and newsworthy geologic updates, good and bad, across our Issuers as they arise. The letters represent the opinions of CPM, as an exploration industry advocate, on the overall geologic progress of our activist strategy in creating new economic metal deposits in viable mining jurisdictions around the world. Each Issuer discussed has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategies holdings. The Issuers discussed may or may not be held in such portfolios at any given time. The Issuers discussed do not represent all of the investments purchased or sold by Funds managed by CPM. It should not be assumed that any or all of these investments were or will be profitable.

Projected results and statements contained in this letter that are not historical facts are based on current expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results. While investing in the mining industry is inherently risk, CPM believes that under a professionally managed portfolio approach with the guidance of Quinton Hennigh, PhD, CPM’s full-time Geologic and Technical Director, and our proprietary exploration and mining model, we will be able to generate long-term capital appreciation.

These opinions are current opinions as of the date appearing in the relevant material and are subject to change without notice. The information contained in the letters is based on publicly available information with respect to the Issuers as of the date of such white papers and has not been updated since such date.

This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security. The information provided in this letter is not intended as investment advice or recommendation to buy or sell any type of investment, or as an opinion on, or a suggestion of, the merits of any particular investment strategy.

This letter is not intended to be, nor should it be construed as, a marketing or solicitation vehicle for CPM or its Funds. The information herein does not provide a complete presentation of the investment strategies or portfolio holdings of the Funds and should not be relied upon for purposes of making an investment or divestment decision with respect to the Funds. Those who are considering an investment in the Funds should carefully review the relevant Fund’s offering memorandum and the information concerning CPM, including its SEC Form ADV Brochure which is available at: www.adviserinfo.sec.gov.

This presentation should not be construed as legal, tax, investment, financial or other advice. It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation and should not be taken as advice on the merits of any investment decision. The views expressed in this presentation represent the opinions of CPM and are based on publicly available information with respect to the Issuer. CPM recognizes that there may be confidential information in the possession of the Issuer that could lead the Issuer to disagree with CPM’s conclusions.

CPM currently beneficially owns, and/or has an economic interest in, shares of the Issuers discussed in these letters. Therefore, CPM’s clients, principals and employees may stand to realize significant gains or losses if the price of the companies’ securities move. After the publication or posting of any video, CPM, its principals and employees will continue transacting in the securities discussed, and may be long, short or neutral at any time thereafter regardless of their initial position or recommendation. While certain individuals affiliated with CPM are current or former directors of certain of the Issuers referred to herein, none of the information contained in this presentation or otherwise provided to you is derived from non-public information of such publicly traded companies. CPM has not sought or obtained consent from any third party to use any statements or information indicated herein that have been obtained or derived from statements made or published by such third parties.

The estimates, projections, pro forma information and potential impact of CPM’s analyses set forth herein are based on assumptions that CPM believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee (i) that any of the proposed actions set forth in this presentation will be completed, (ii) that actual results or performance of the Issuer will not differ, and such differences may be material or (iii) that any of the assumptions provided in this presentation are accurate.

All content posted on CPM’s letters including graphics, logos, articles, and other materials, is the property of CPM or others and is protected by copyright and other laws. All trademarks and logos are the property of their respective owners, who may or may not be affiliated with CPM. Nothing contained on CPM’s website or social media networks should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any content or trademark displayed on any site without the written permission of CPM or such other third party that may own the content or trademark displayed on any site.

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm.

1 – Fund net performance is calculated based upon an unrestricted, full fee-paying “Main Class” investor who came in at inception and is eligible to invest in new issues. Investment results shown are for taxable and taxexempt accounts. Any possible tax liabilities incurred by the taxable accounts are not reflected in net performance. An actual client’s results may vary due to the timing of capital transactions, high watermarks, and performance. Performance results reflect the deduction of advisory fees, incentive fees, brokerage commissions, and other expenses that a client would have paid, and includes the reinvestment of dividends and other earnings.

2 – The SMA composites include all accounts that are managed according to CPM’s precious metals or large cap SMA strategy over which it has full discretion. Investment results shown are for taxable and tax-exempt accounts. Any possible tax liabilities incurred by the taxable accounts are not reflected in net performancePerformance results are time weighted and reflect the deduction of advisory fees, brokerage commissions, and other expenses that a client would have paid, and includes the reinvestment of dividends and other earnings.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in CPM’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each CPM hedge fund for complete information and risk factors.